Decentralized Finance (DeFi) has emerged as one of the most exciting and promising developments in the cryptocurrency space. With its potential to revolutionize traditional financial systems, DeFi offers users greater control, transparency, and accessibility to their finances. However, navigating this rapidly evolving landscape can be challenging, especially when it comes to managing different DeFi assets across various platforms.

This is where DeBank’s portfolio features come into play. DeBank is a powerful DeFi portfolio management tool that allows users to seamlessly track, manage, and optimize their DeFi investments. Whether you’re a seasoned DeFi investor or just getting started, DeBank’s comprehensive suite of features offers a deep dive into your portfolio, helping you make informed decisions and maximize your returns.

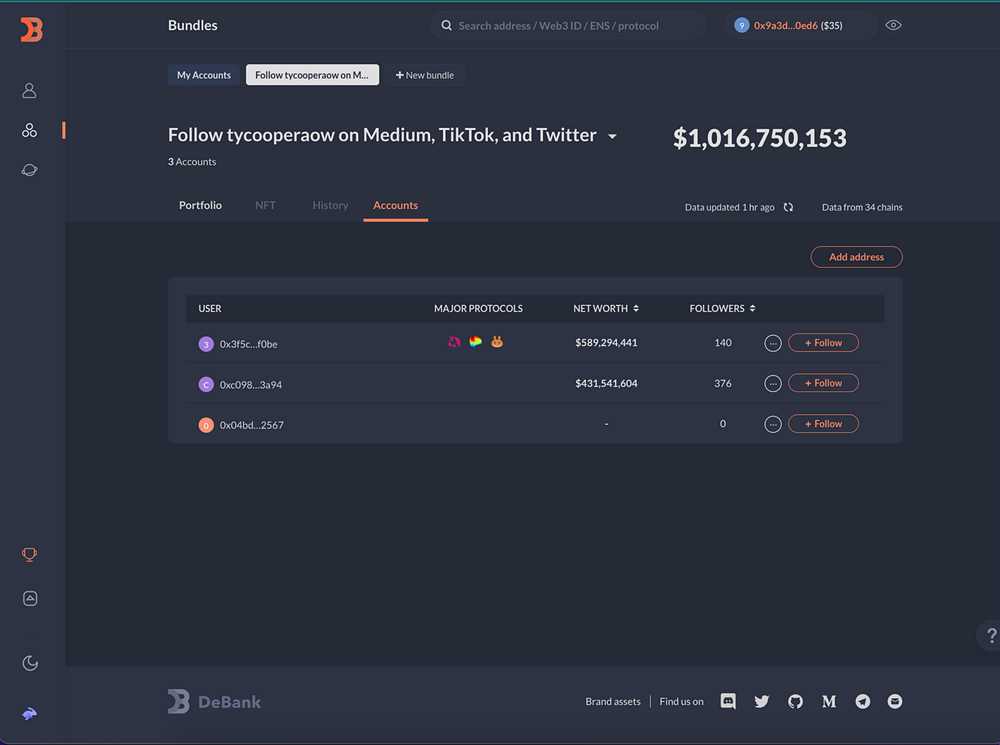

One of the key features of DeBank is its ability to aggregate data from different DeFi protocols and display it in a user-friendly interface. With just a few clicks, you can get a holistic view of your DeFi assets, including their current value, historical performance, and diversification. This enables you to easily track your investments and identify any potential risks or opportunities.

Additionally, DeBank offers advanced analytics tools that allow you to delve deeper into your portfolio’s performance. You can analyze your asset allocation, track your returns over time, and compare your portfolio against various benchmarks. Armed with these insights, you can make data-driven decisions and optimize your investments to achieve your financial goals.

Furthermore, DeBank’s portfolio features go beyond just tracking and analyzing. The platform also allows you to interact with your DeFi assets directly. You can execute transactions, manage your positions, and participate in the governance of various protocols, all from one centralized interface. This streamlines your DeFi operations and saves you time and effort.

In conclusion, DeBank’s portfolio features offer an incredible opportunity to unlock the full potential of DeFi. By providing a comprehensive overview of your investments, advanced analytics tools, and seamless interaction with your assets, DeBank empowers you to make smarter decisions, optimize your returns, and navigate the ever-expanding DeFi ecosystem with confidence.

Unlocking the Power of DeFi

DeFi, or decentralized finance, has been revolutionizing the financial industry by providing unprecedented access to financial services and products. Unlike traditional finance, which is controlled by centralized institutions, DeFi operates on blockchain technology, bringing transparency, security, and inclusivity to the financial world.

One of the key aspects of DeFi is its ability to unlock the power of financial instruments, such as lending, borrowing, and trading, through smart contracts. These contracts eliminate the need for intermediaries and allow users to interact directly with the decentralized protocols, making financial transactions faster, cheaper, and more efficient.

DeBank’s portfolio features play a crucial role in unlocking the power of DeFi. With DeBank, users can manage their DeFi assets holistically, comprehensively analyzing their portfolio’s performance and risk exposure. The platform provides real-time data on various DeFi protocols, enabling users to make informed investment decisions and take advantage of lucrative opportunities.

Additionally, DeBank’s portfolio features allow users to track the performance of their investments, monitor the status of their loans, and manage their collateral. With a user-friendly interface, users can easily navigate the complexities of DeFi and optimize their portfolio for maximum returns.

Furthermore, DeBank’s portfolio features enable users to diversify their holdings across different DeFi protocols, mitigating risks and ensuring a more stable investment portfolio. By providing detailed analytics and insights, the platform empowers users to make data-driven decisions, minimizing the likelihood of losses and maximizing their overall financial gains.

In conclusion, DeFi has unlocked the power of decentralized finance, revolutionizing the financial industry. Through platforms like DeBank and their portfolio features, users can effectively manage their assets, track their investments, and optimize their portfolio for maximum returns. With the increasing adoption of DeFi, the power of decentralized finance will continue to grow, transforming the way we interact with money and financial services.

A Deep Dive into DeBank’s Portfolio Features

DeBank is a powerful platform that provides users with a comprehensive set of portfolio features. These features are designed to help users track, manage, and optimize their DeFi investments. In this article, we will explore some of the key portfolio features offered by DeBank.

1. Portfolio Overview

The portfolio overview provides users with a bird’s-eye view of their DeFi holdings. Users can easily see the total value of their portfolio, as well as their gains and losses over time. This feature allows users to quickly assess the performance of their investments and make data-driven decisions.

2. Asset Allocation

DeBank’s asset allocation feature allows users to understand how their investments are distributed across different assets. Users can see the percentage of their portfolio that is allocated to each asset, helping them identify any potential imbalances. This feature is valuable for users who want to maintain a diversified portfolio and manage risk effectively.

3. Transaction History

The transaction history feature provides users with a detailed record of all their DeFi transactions. Users can view information such as the date, time, and amount of each transaction, as well as the wallets and protocols involved. This feature is especially useful for users who want to track their trading activity and ensure accurate accounting.

4. Yield Farming Analytics

For users who are engaged in yield farming, DeBank offers powerful analytics to help them optimize their strategies. Users can track their farming positions in real-time, monitor their farming yields, and compare various farming pools. These analytics enable users to make informed decisions and maximize their yield farming profits.

5. Risk Monitoring

DeBank’s risk monitoring feature provides users with real-time alerts and notifications for potential risks. Users can set up custom alerts based on their preferred risk thresholds and receive instant alerts if any of their investments are exposed to significant risks. This feature helps users stay proactive and take timely actions to mitigate risks.

6. Portfolio Export

DeBank allows users to easily export their portfolio data for further analysis or record-keeping purposes. Users can export their portfolio data in various formats, such as CSV or JSON, and use it in external tools or platforms. This feature provides users with the flexibility to analyze their portfolio data in a way that suits their needs.

In conclusion, DeBank’s portfolio features offer users a comprehensive set of tools to track, manage, and optimize their DeFi investments. Whether you are a beginner or an experienced DeFi investor, DeBank’s portfolio features can help you achieve your investment goals.

Understanding DeFi

Decentralized Finance, or DeFi, refers to a movement in the financial industry that aims to provide accessible and open financial services using blockchain technology. Unlike traditional financial systems that rely on intermediaries such as banks and other financial institutions, DeFi aims to remove these intermediaries and create a more transparent and inclusive financial ecosystem.

At its core, DeFi leverages smart contract technology to automate and execute financial transactions without the need for intermediaries. This enables individuals to directly interact with the DeFi protocols and access a variety of financial services such as lending, borrowing, trading, and earning interest on their digital assets.

Key Characteristics of DeFi

- Decentralization: DeFi platforms are built on decentralized networks, typically blockchain, where no single entity has control over the entire system. Instead, decision-making power is distributed among a network of participants.

- Transparency: DeFi transactions and operations are recorded on a public blockchain, making them fully transparent and auditable. Anyone can verify and track these transactions in real-time.

- Open Access: DeFi services are open to anyone with an internet connection, irrespective of their geographical location, nationality, or socioeconomic status. This open access allows for greater financial inclusion.

- Interoperability: DeFi protocols can communicate and interact with each other, allowing for the development of more complex financial applications. This interoperability enables users to seamlessly move their assets between different DeFi platforms.

Benefits of DeFi

DeFi offers several advantages over traditional financial systems:

- Greater Financial Inclusion: DeFi opens up access to financial services for the unbanked and underbanked populations who may not have access to traditional banking services.

- Reduced Costs: By eliminating intermediaries, DeFi cuts down on transaction fees and other costs associated with traditional financial services.

- Increased Security: DeFi transactions are secured by the underlying blockchain technology, making them resistant to hacks and fraud. Additionally, users maintain control over their private keys and digital assets.

- Permissionless Innovation: DeFi allows developers to build and deploy financial applications without requiring permission from centralized authorities, fostering innovation and experimentation.

In conclusion, DeFi revolutionizes the financial landscape by bringing transparency, accessibility, and innovation to the forefront. As the industry continues to evolve, new DeFi protocols and applications will continue to emerge, paving the way for a more decentralized and inclusive financial future.

What is DeFi?

DeFi, short for Decentralized Finance, refers to the use of blockchain technology and smart contracts to create decentralized financial products and services. It aims to provide open, permissionless, and transparent alternatives to traditional centralized financial systems.

What are the portfolio features offered by DeBank?

DeBank offers a range of portfolio features to help users manage and track their investments in decentralized finance. These include portfolio tracking, asset analysis, risk assessment, and performance monitoring.

How does DeBank’s portfolio tracking feature work?

DeBank’s portfolio tracking feature allows users to connect their Ethereum wallet and automatically retrieve their DeFi investments. It gives users a comprehensive overview of their portfolio, including the total value, individual asset positions, and percentage allocation.

Can I analyze the performance of my DeFi assets using DeBank?

Yes, DeBank’s portfolio features include asset analysis tools that allow users to assess the performance of their DeFi assets. Users can view historical price charts, track investment returns, and compare asset performance against benchmarks.

Does DeBank provide risk assessment for DeFi investments?

Yes, DeBank’s portfolio features include risk assessment tools that provide users with insights into the risk profile of their DeFi investments. Users can evaluate the risk-reward ratio, assess the volatility of their portfolio, and identify potential vulnerabilities in the underlying smart contracts.