Building a successful crypto and DeFi portfolio requires more than just luck or guesswork – it requires meticulous research and careful consideration of various factors. With the rapid growth and evolution of the cryptocurrency market, staying informed and making informed decisions is crucial.

Cryptocurrencies and DeFi projects are highly volatile and unpredictable, making thorough research even more essential. By conducting proper research, investors can gain a deep understanding of the market trends, project fundamentals, and potential risks, allowing them to make educated decisions and minimize the risks associated with investing.

Researching the underlying technology, team, and overall market sentiment can help investors identify projects with strong potential and innovative solutions. It is important to analyze the team’s expertise, track record, and transparency to gauge their ability to deliver on their promises.

Furthermore, researching the market sentiment and ongoing discussions within the community can provide valuable insights into the credibility and attractiveness of a project. Monitoring news, forums, and social media platforms can help investors stay updated on any potential red flags or positive developments surrounding a project.

By conducting thorough research, investors can also identify potential risks and pitfalls associated with a project or the overall market. Understanding the regulatory environment and compliance measures of a project is crucial to avoid any legal or regulatory issues in the future.

In summary, conducting thorough research is essential when building a DeBank crypto and DeFi portfolio. It enables investors to make informed decisions, identify promising projects, and mitigate potential risks. By staying informed and conducting due diligence, investors can maximize their chances of success in the ever-changing crypto market.

The Importance of Research in Building a Successful DeBank Crypto & DeFi Portfolio

When it comes to investing in the world of cryptocurrencies and decentralized finance (DeFi), research plays a crucial role in building a successful portfolio. With the ever-evolving landscape and constant introduction of new projects, conducting thorough research allows investors to make informed decisions and mitigate risks.

Understanding the Market

Researching the crypto market is essential for anyone looking to invest in DeBank projects. It is necessary to stay up to date with the latest trends, news, and developments to understand the potential opportunities and risks associated with different assets. By analyzing market trends and studying historical data, investors can identify patterns and make better-informed decisions.

Additionally, it is crucial to familiarize yourself with the various cryptocurrencies and DeFi protocols available. Each project has its unique features, use case, and potential risks. Through research, investors can gain a comprehensive understanding of the fundamentals and evaluate the long-term viability of an asset.

Evaluating Projects

Researching individual projects within the DeBank ecosystem is essential to identify high-potential investments. By evaluating factors such as the team behind the project, its technology, partnerships, and community engagement, investors can assess the project’s credibility and potential for success.

Furthermore, conducting due diligence on the security measures and code auditing of a DeFi protocol is crucial to ensure the investor’s funds are protected. Researching the project’s smart contract vulnerabilities and any past security incidents can provide valuable insights into the level of risk associated with an investment.

It is important to note that investing in cryptocurrencies and DeFi projects carries inherent risks, including the potential loss of funds. Therefore, conducting thorough research and consulting with financial professionals is recommended before making any investment decisions.

Staying Informed

The crypto market is highly dynamic, with new projects, partnerships, and regulatory developments emerging regularly. To stay ahead in this ever-changing landscape, continuous research is essential. Following reputable news sources, engaging with the crypto community, and attending conferences and webinars can provide valuable insights and keep investors up to date.

Moreover, staying informed about regulatory changes and compliance requirements is crucial in the world of DeFi. Regulations can significantly impact the value and legality of different assets, so being aware of any potential changes can help investors make more informed decisions and navigate the market effectively.

In conclusion, research is vital in building a successful DeBank crypto and DeFi portfolio. By understanding the market, evaluating projects, and staying informed, investors can make better-informed investment decisions and reduce potential risks.

Understanding the Current Crypto & DeFi Landscape

As the world of finance continues to evolve, the crypto and DeFi landscape has emerged as a significant player. Cryptocurrencies and decentralized finance (DeFi) are revolutionizing the way we transact, invest, and interact with financial systems.

The Rise of Cryptocurrencies

Cryptocurrencies, like Bitcoin and Ethereum, have gained significant popularity and recognition over the past decade. They provide a decentralized and secure way of conducting transactions, free from intermediaries and central control. These digital assets are based on blockchain technology, which ensures transparency and immutability.

The crypto market is highly volatile, with prices fluctuating rapidly based on various market factors, including supply and demand, investor sentiment, and regulatory changes. It’s crucial to stay updated with the latest news, market trends, and understand the underlying technology when evaluating cryptocurrencies for your portfolio.

The Emergence of DeFi

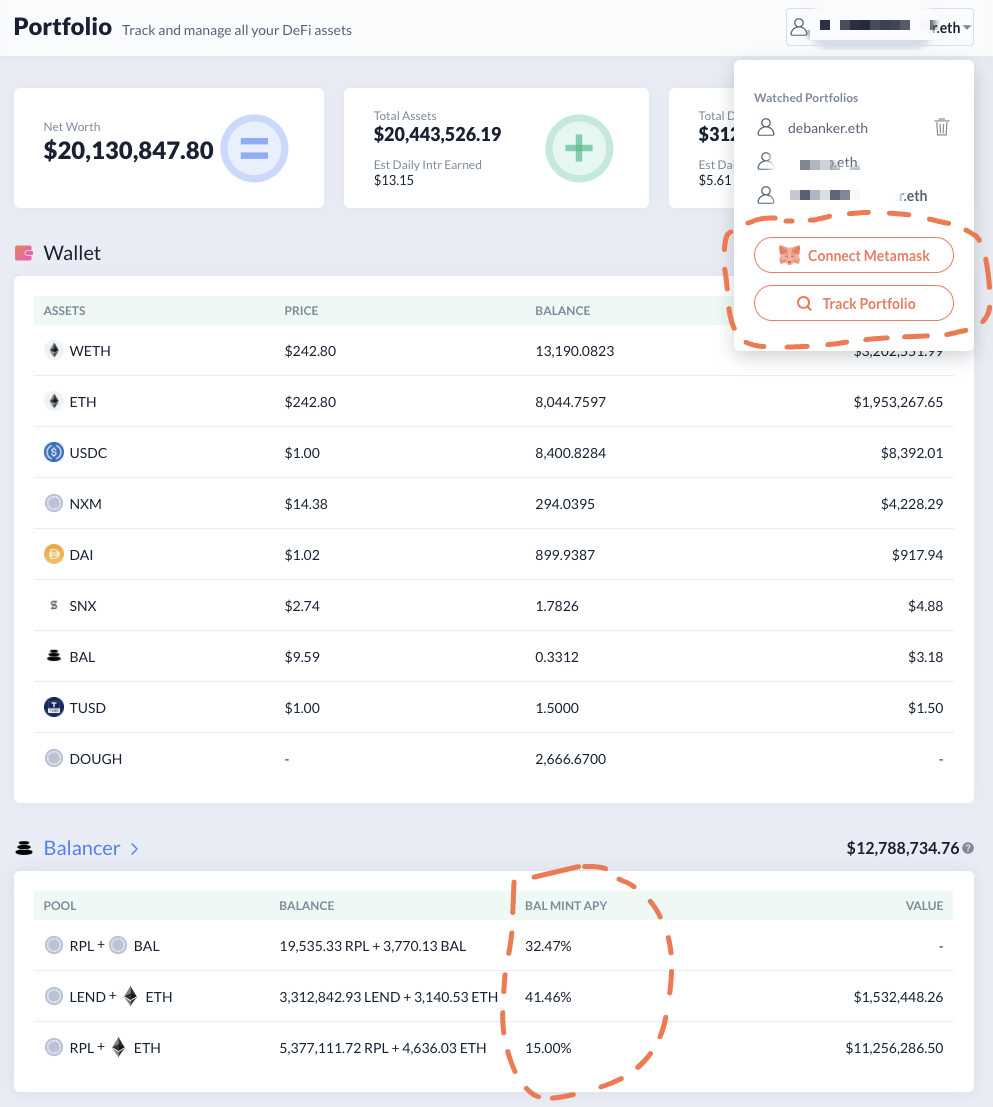

Decentralized finance, also known as DeFi, is an innovative concept that aims to bring traditional financial services to the blockchain. It offers various decentralized applications (dApps) that allow users to lend, borrow, trade, or invest in cryptocurrencies without intermediaries like banks or brokers.

The DeFi sector has experienced exponential growth, with a wide range of projects and protocols emerging based on different use cases, such as decentralized exchanges (DEXs), liquidity pools, yield farming, and decentralized lending platforms. As the DeFi landscape evolves, it’s essential to research and understand the risks and opportunities associated with different DeFi projects before making investment decisions.

- Research the background and team behind the project

- Assess the security and auditing measures in place

- Understand the tokenomics and governance structure

- Analyze the market demand and potential adoption

Additionally, keeping an eye on the overall market sentiment and regulatory developments surrounding DeFi is crucial. The DeFi space is relatively new and rapidly evolving, so staying informed is essential to navigate this dynamic landscape.

Overall, understanding the current crypto and DeFi landscape requires thorough research, keeping up with market trends, and evaluating the risks and opportunities associated with different projects. By staying informed and leveraging this knowledge, you can make more informed decisions when building your DeBank crypto and DeFi portfolio.

How can research help when building a DeBank crypto portfolio?

Research is crucial when building a DeBank crypto portfolio because it allows investors to make informed decisions. By conducting thorough research, investors can analyze factors such as the project’s team, technology, market potential, and competition. This helps them to identify the most promising projects and avoid scams or projects with little potential for growth.

What are some important factors to consider when researching crypto projects for a DeBank portfolio?

When researching crypto projects for a DeBank portfolio, it is important to consider several factors. These include the project’s team and their expertise, the technological innovation behind the project, its market potential and competition, the project’s roadmap and development progress, as well as its community and user adoption. Evaluating these factors can help investors make more informed decisions and select projects with strong growth potential.