Are you looking to maximize your returns in the world of cryptocurrencies and decentralized finance (DeFi)?

With the rapid growth and ever-changing nature of the market, it’s crucial to stay ahead of the curve and identify emerging opportunities.

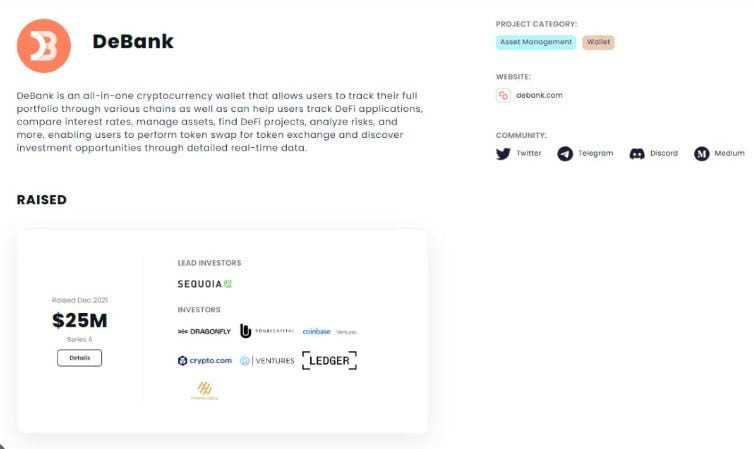

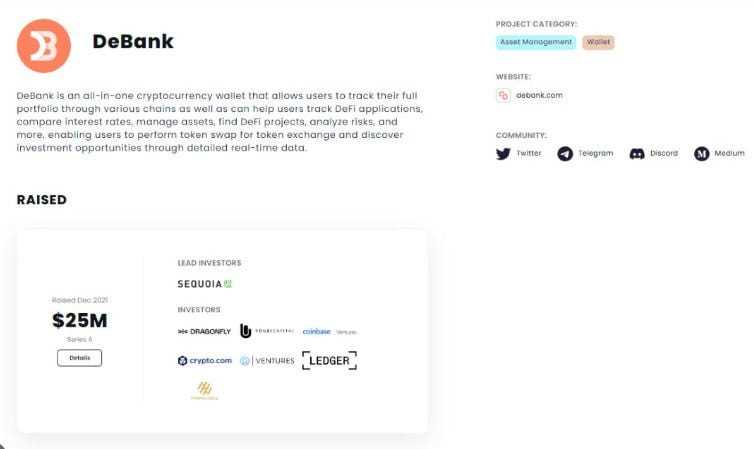

At DeBank Crypto & DeFi, we understand the importance of strategic analysis in making informed investment decisions. Our team of experts specializes in analyzing market trends to help you identify the most promising opportunities for your portfolio.

Using cutting-edge technology and comprehensive research, we track the latest developments in the crypto and DeFi space. Our in-depth analysis uncovers hidden gems and potential winners that can supercharge your portfolio.

Our approach combines data analysis with a deep understanding of the market dynamics. We carefully analyze the performance of various cryptocurrencies and DeFi projects, identifying factors that drive their growth and profitability.

Whether you’re a seasoned investor or new to the game, our insights and recommendations can help you navigate the complex world of crypto and DeFi with confidence. We provide you with actionable strategies that align with your investment goals and risk tolerance.

Don’t rely on guesswork when it comes to building your crypto and DeFi portfolio. Let DeBank Crypto & DeFi be your trusted partner in identifying lucrative opportunities and maximizing your returns.

Take the first step towards realizing your financial goals – contact us today!

Analyzing Market Trends

As a DeBank Crypto & DeFi investor, staying informed about market trends is crucial for identifying opportunities and making informed investment decisions. Analyzing market trends allows you to understand the current state of the market, predict future developments, and adjust your portfolio accordingly.

Why Analyzing Market Trends Matters

Analyzing market trends provides valuable insights into the dynamics of the cryptocurrency and decentralized finance (DeFi) markets. By studying market trends, you can:

- Identify emerging investment opportunities

- Anticipate market trends and potential price movements

- Determine the best time to enter or exit a specific market

- Stay ahead of competitors and maintain a competitive edge

- Minimize risks and maximize potential profits

By analyzing market trends, you can effectively assess the overall health of the cryptocurrency and DeFi sectors, identify potential risks and challenges, and make informed decisions to optimize your DeBank portfolio.

Tools and Strategies for Analyzing Market Trends

There are various tools and strategies you can utilize to analyze market trends:

| Tool/Strategy | Description |

|---|---|

| Technical Analysis | Examining historical price and volume data to predict future price movements. |

| Fundamental Analysis | Evaluating the underlying value and potential of a cryptocurrency or DeFi project. |

| Sentiment Analysis | Monitoring social media, news, and forums to gauge market sentiment and investor behavior. |

| Quantitative Analysis | Using statistical models and algorithms to analyze large volumes of data for patterns and trends. |

| Industry Research | Staying updated on industry developments, partnerships, regulations, and technological advancements. |

By combining these tools and strategies, you can gain a comprehensive understanding of market trends and make more informed decisions for your DeBank Crypto & DeFi portfolio.

In conclusion, analyzing market trends is essential for any investor in the cryptocurrency and DeFi space. By staying informed and utilizing various tools and strategies, you can identify opportunities, mitigate risks, and optimize your investment strategy to achieve success in the dynamic and rapidly evolving crypto market.

Identifying Opportunities

When it comes to investing in the volatile world of cryptocurrencies and decentralized finance (DeFi), identifying opportunities is crucial. By analyzing market trends and staying informed, you can position yourself for success in the ever-changing landscape.

Research Market Trends

The first step in identifying opportunities for your DeBank Crypto & DeFi portfolio is to research market trends. This involves analyzing data, studying charts, and understanding industry news. By keeping a close eye on the market, you can identify emerging trends and potential investment opportunities.

Stay Informed

Staying informed is key to identifying opportunities in the DeBank Crypto & DeFi space. Subscribe to industry newsletters, join online communities, and follow thought leaders in the space. By staying up to date with the latest news and insights, you can gain valuable knowledge that will help you spot potential opportunities.

| Key Factors to Consider | How to Identify Opportunities |

|---|---|

| 1. Technology advancements | Stay updated on new technologies and their potential impact on the market. |

| 2. Regulatory changes | Monitor regulatory developments to identify potential opportunities and risks. |

| 3. Market demand | Identify emerging trends and areas with high market demand. |

| 4. Competitive landscape | Analyze the competition to find gaps and areas for differentiation. |

| 5. User adoption | Look for projects and technologies that have a growing user base. |

By researching market trends, staying informed, and considering key factors, you can effectively identify opportunities for your DeBank Crypto & DeFi portfolio. Remember, investing in cryptocurrencies and DeFi is highly volatile and carries risks, so always do your own due diligence and consult with a financial advisor before making any investment decisions.

DeBank Crypto & DeFi

DeBank Crypto & DeFi is a revolutionary platform that allows users to unlock the full potential of their cryptocurrency investments. Our sophisticated analysis tools and market trends insights empower investors to identify lucrative opportunities in the ever-evolving world of cryptocurrencies and decentralized finance (DeFi).

With DeBank Crypto & DeFi, you can stay ahead of the curve by tracking market trends, analyzing the performance of various cryptocurrencies, and identifying potential high-growth assets. Our platform provides intuitive charts, real-time data, and comprehensive reports, ensuring you have all the information you need to make informed investment decisions.

Our team of experts continuously monitors the crypto market and analyzes market trends to identify emerging opportunities. Whether it’s a new DeFi project, a promising altcoin, or a groundbreaking technological advancement, we ensure that you have the first-mover advantage to capitalize on these opportunities before they become mainstream.

DeBank Crypto & DeFi is more than just a portfolio management tool. It’s a community of like-minded investors and enthusiasts who share insights, strategies, and ideas. Our platform fosters collaboration and knowledge sharing, empowering users to learn from each other and stay updated on the latest industry developments.

Join DeBank Crypto & DeFi today and unlock the potential of your cryptocurrency investments. Stay ahead of the curve, identify lucrative opportunities, and maximize your returns in the fast-paced world of crypto and DeFi.

Portfolio Management

Effective portfolio management is crucial for maximizing returns and minimizing risks in your DeBank Crypto & DeFi portfolio. Here are some key strategies to consider:

Diversify Your Holdings

It is important to diversify your portfolio by investing in a variety of cryptocurrencies and decentralized finance (DeFi) projects. This helps spread out the risk and reduces the impact of any negative developments in a single investment.

Set Clear Investment Goals

Before making any investment decisions, it is essential to define clear investment goals. Whether you are looking for short-term gains or long-term wealth accumulation, having specific goals can help guide your investment strategy.

- Identify Your Risk Tolerance

- Assess your risk tolerance level to determine the types of investments that align with your risk appetite. Some investments may be more volatile than others, so it is important to understand your comfort level with potential fluctuations in value.

Regularly Monitor and Rebalance Your Portfolio

Market conditions and trends can change rapidly in the crypto and DeFi space. It is crucial to regularly monitor your investments and adjust your portfolio accordingly. This may involve rebalancing your holdings to maintain the desired asset allocation.

- Stay Informed

- Stay updated on the latest industry news and market trends. This will help you make informed decisions about your portfolio and take advantage of potential opportunities.

- Seek Professional Advice

- If you are new to crypto and DeFi investing, consider seeking advice from a financial professional who specializes in this field. They can provide valuable insights and guidance based on their expertise.

By implementing these portfolio management strategies, you can enhance the potential returns of your DeBank Crypto & DeFi portfolio while effectively managing risks.