Introducing the revolutionary Debank API – your solution to complex compliance challenges.

Are you tired of navigating through endless regulatory hurdles?

With the Debank API, you can streamline your compliance processes and stay ahead in today’s ever-changing regulatory landscape.

Unlocking your business potential has never been easier.

Why choose the Debank API?

1. Efficiency: Say goodbye to manual paperwork and time-consuming compliance checks. The Debank API automates your compliance processes, saving you time and resources.

2. Accuracy: Our advanced technology ensures accurate and up-to-date compliance checks, minimizing the risk of non-compliance and potential penalties.

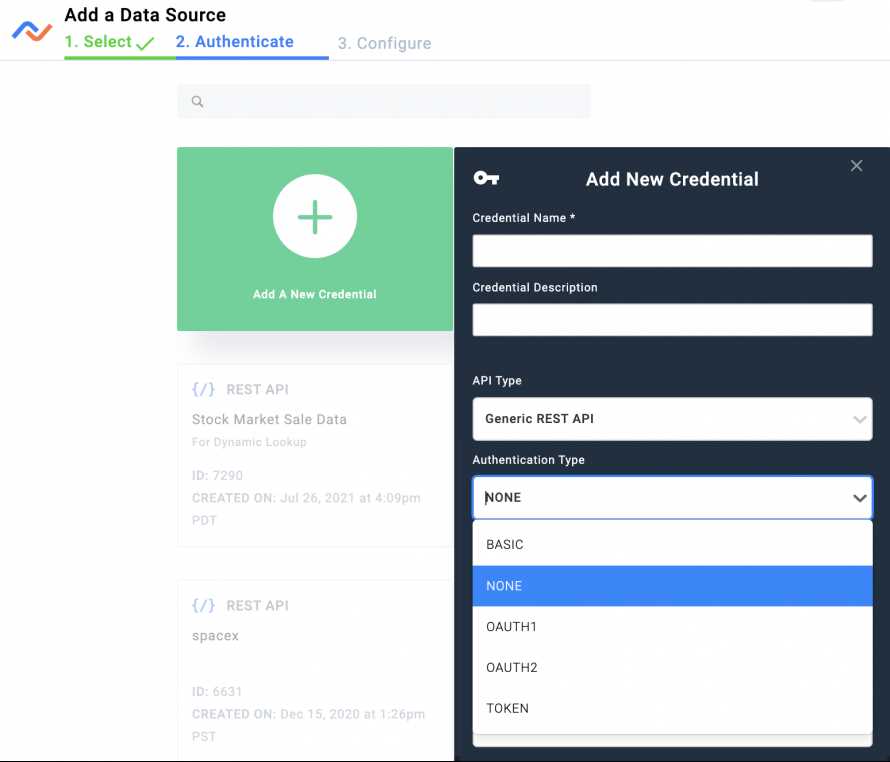

3. Seamless Integration: The Debank API seamlessly integrates with your existing systems, making implementation quick and hassle-free.

4. Robust Security: Your data security is our top priority. The Debank API is built with industry-leading security measures to protect your sensitive information.

Experience the Debank API difference today!

Don’t let compliance challenges hold you back. Contact us now to learn more about how the Debank API can transform your business compliance processes.

Understanding Compliance Challenges

In today’s rapidly evolving regulatory landscape, businesses across various industries are facing an increasing number of compliance challenges. Compliance refers to the adherence to laws, regulations, and industry standards designed to promote fair practices, protect consumers, and maintain trust in the financial system.

One of the main compliance challenges that businesses encounter is the complexity of regulatory requirements. Regulations can vary greatly depending on the industry, geographical location, and the type of business activity. This complexity often leads to confusion and difficulties in understanding and implementing the necessary measures to achieve compliance.

Another compliance challenge is the ever-changing nature of regulations. Governments and regulatory bodies continuously update and revise existing regulations or introduce new ones to address emerging risks and protect against financial crimes, such as money laundering and fraud. Staying up-to-date with these changes and effectively implementing them can be a significant challenge for businesses.

The cost of complying with regulations is also a significant challenge for many businesses. Compliance measures often require financial investments in technologies, training programs, and internal processes. The financial burden associated with compliance can be particularly challenging for small and medium-sized enterprises (SMEs) that have limited resources and may struggle to allocate funds for compliance-related activities.

An additional compliance challenge is the need for effective data management and privacy protection. Regulations often require businesses to collect, store, and process sensitive customer data. Ensuring the security and privacy of this data is crucial to comply with regulations and maintain customer trust. Implementing robust data management practices and cybersecurity measures can be complex and resource-intensive.

To address these compliance challenges, businesses can leverage innovative solutions like the Debank API. The Debank API provides businesses with a powerful tool to streamline compliance processes, automate regulatory reporting, and ensure adherence to the latest regulations. By integrating the Debank API into their systems, businesses can effectively manage compliance requirements, reduce the risk of non-compliance, and allocate resources more efficiently.

Overall, understanding and navigating compliance challenges is essential for businesses to maintain regulatory compliance, protect their reputation, and foster trust with customers and stakeholders. The Debank API offers a comprehensive solution to overcome these challenges and meet compliance obligations effectively.

The Role of the Debank API

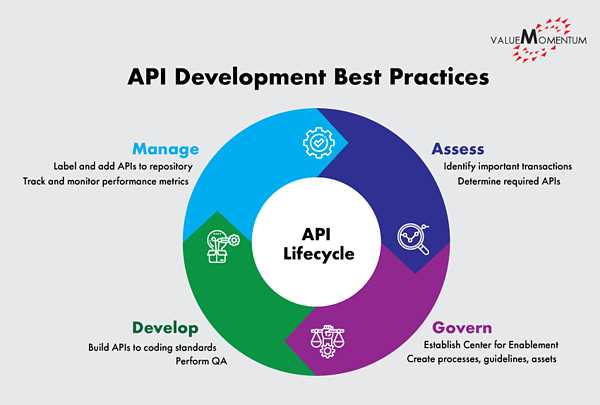

The Debank API plays a crucial role in overcoming compliance challenges and streamlining the process for businesses. By integrating the Debank API into their systems, companies can ensure quick and efficient compliance with regulatory requirements, reducing the risk of violations and penalties.

Real-Time Data

One of the primary functions of the Debank API is to provide businesses with real-time data on compliance regulations. Through this API, companies can access the latest information on KYC (Know Your Customer) procedures, AML (Anti-Money Laundering) regulations, and other compliance standards. This ensures that businesses can stay up to date with any changes in the regulatory landscape and make the necessary adjustments to their processes.

Automated Compliance Checks

The Debank API also automates compliance checks, allowing businesses to verify customer information and conduct due diligence more efficiently. By integrating this API into their systems, companies can seamlessly verify customer identities, perform sanctions screenings, and detect any suspicious activities. This helps businesses to identify potential risks and take proactive measures to ensure compliance.

Moreover, the Debank API simplifies the compliance process by reducing the manual effort involved. With its user-friendly interface and robust features, businesses can easily navigate through the compliance verification process, saving time and resources.

Streamlined Reporting

Another key role of the Debank API is to streamline reporting for businesses. The API provides businesses with a comprehensive reporting system, allowing them to generate compliance reports accurately and efficiently. By automating the report generation process, companies can ensure that they are meeting their reporting obligations and maintaining transparency with regulatory authorities.

In summary, the Debank API plays a crucial role in helping businesses overcome compliance challenges. By providing real-time data, automating compliance checks, and streamlining reporting, this API empowers companies to meet regulatory requirements effectively and mitigate compliance risks.

Benefits of Using the Debank API

Streamlined Compliance Processes: By integrating the Debank API into your system, you can simplify and automate your compliance procedures. The API provides a seamless way to access and verify important customer information, such as KYC and AML checks, saving you time and effort.

Enhanced Data Accuracy: The Debank API offers real-time data retrieval, ensuring that the information you receive is always up to date and accurate. This helps you make informed decisions and reduces the risk of errors or outdated data affecting your compliance activities.

Flexible Integration Options: Whether you’re using a web-based platform or a mobile application, the Debank API can be easily integrated into your existing infrastructure. Its flexible integration options allow you to adapt it to your specific needs, ensuring a smooth and seamless integration process.

Cost and Time Savings: By using the Debank API, you can significantly reduce the time and resources required to manually review and process compliance-related tasks. This not only increases operational efficiency but also helps you save on costs associated with hiring additional staff or relying on outdated compliance systems.

Improved Risk Management: The Debank API provides real-time risk analysis capabilities, helping you identify and mitigate potential risks in a timely manner. This allows you to proactively manage compliance risks and stay ahead of regulatory changes, ensuring your business remains compliant.

Enhanced Customer Experience: With the Debank API, you can offer a smoother onboarding process for your customers. By automating compliance procedures, you can reduce the time and effort required from your customers, providing them with a more positive and efficient experience.

Scalability and Growth Opportunities: The Debank API is designed to handle large volumes of data and transactions, making it a scalable solution for businesses of all sizes. By leveraging its capabilities, you can easily accommodate increased business growth and expansion without compromising on compliance standards.

Overall, the Debank API offers numerous benefits for businesses looking to overcome compliance challenges. From streamlining processes to enhancing data accuracy and improving risk management, the API empowers businesses to stay compliant while reducing costs and enhancing the customer experience.

What is the Debank API?

The Debank API is an application programming interface that allows businesses to overcome compliance challenges related to financial transactions.

How does the Debank API help businesses overcome compliance challenges?

The Debank API provides businesses with access to advanced compliance tools and features, such as identity verification, transaction monitoring, and risk assessment, to ensure that they are in compliance with financial regulations.