DeBank, a revolutionary decentralized banking platform, has been making waves in the financial industry. As more and more people are starting to believe in the potential of blockchain technology, DeBank has emerged as a frontrunner, utilizing the power of cryptocurrency to create a new financial ecosystem. To truly understand how DeBank operates, it is crucial to delve into its tokenomics – the economic system that underpins its success.

Tokenomics refers to the study of the design principles of a cryptocurrency and how it functions within a given ecosystem. In the case of DeBank, its tokenomics is designed to create a self-sustaining economy that benefits both the platform and its users. The platform’s native token, known as “DeCoin,” plays a central role in this ecosystem.

DeCoin serves multiple purposes within the DeBank ecosystem. Firstly, it acts as a medium of exchange, enabling users to carry out transactions on the platform. Whether it’s transferring funds, making payments, or accessing various financial services, DeCoin is the primary currency used. This promotes liquidity and facilitates seamless transactions within the platform.

DeBank’s Tokenomics: A Comprehensive Overview

DeBank’s tokenomics refers to the economics and distribution of its native token, DBK. In order to understand the tokenomics of DeBank, it is important to explore its various aspects and how they contribute to the overall economy of the platform.

Token Supply

The total supply of DBK tokens is fixed at 1 billion tokens. This fixed supply ensures that the value of each token is not diluted over time and helps maintain the scarcity of the token.

Distribution

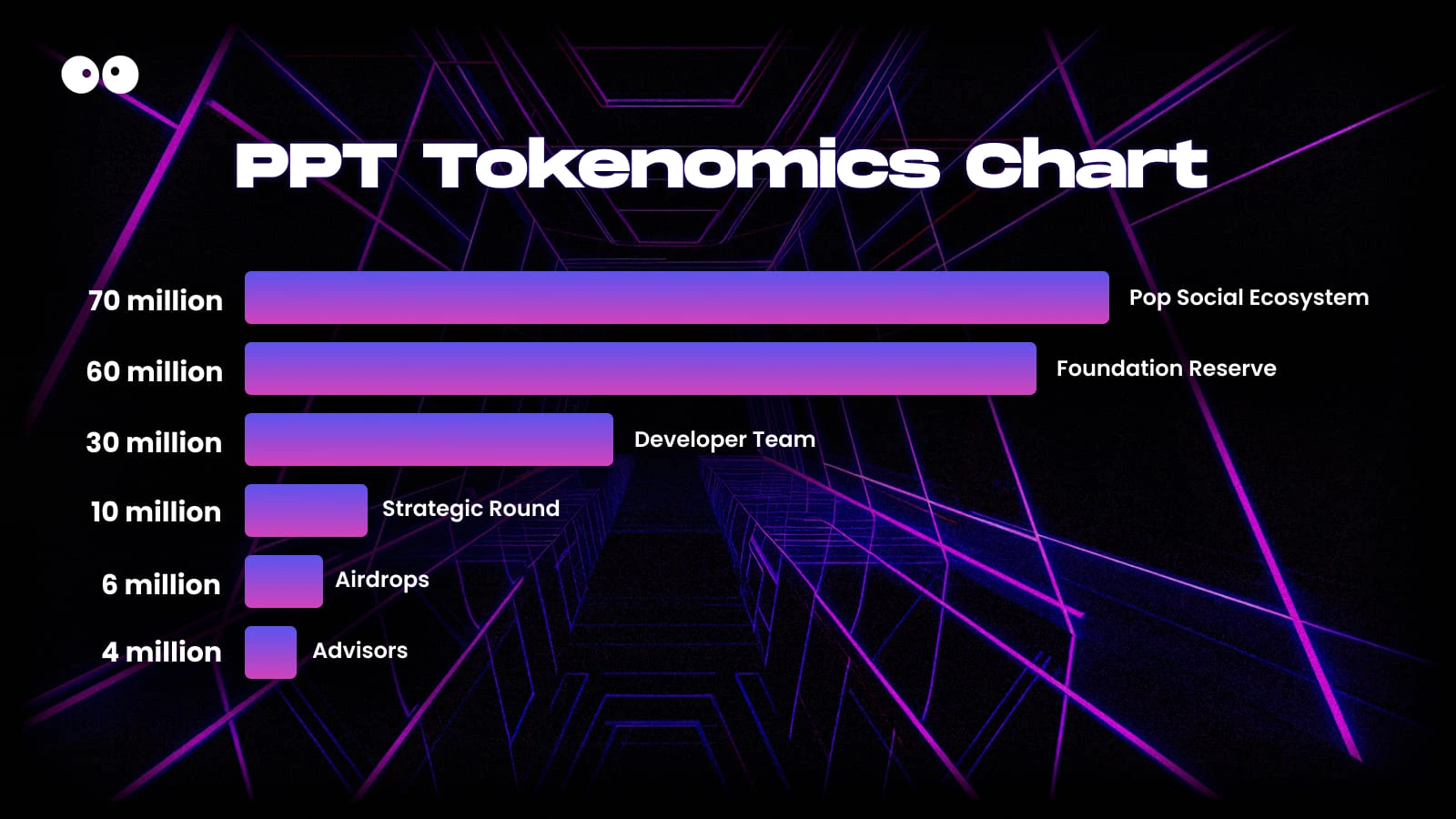

The initial distribution of DBK tokens was conducted through a private sale and a public sale. The private sale was held to strategic investors who showed interest in supporting the development of DeBank. The public sale allowed retail investors to participate and acquire DBK tokens.

A portion of the DBK tokens is also allocated to the team and advisors of DeBank, ensuring their long-term commitment and aligning their interests with the success of the platform. Additionally, a certain amount of tokens is dedicated to the ecosystem fund, which will be used to incentivize developers, partners, and community members who contribute to the growth and adoption of DeBank.

Utilization

The DBK token serves various purposes within the DeBank ecosystem. It can be used for staking and participating in the governance of the platform. Token holders are given the opportunity to vote on important proposals and decisions that affect DeBank’s operations and future development.

Furthermore, DBK tokens can be used as a medium of exchange within the DeBank ecosystem. They can be used to access premium features, pay for transaction fees, or as a store of value. The utility of the token is designed to create a self-sustaining economy within DeBank, where the demand for the token is driven by its usefulness and the growth of the platform.

Economic Model

The economic model of DeBank’s tokenomics is designed to ensure the long-term value appreciation of the DBK token. As the adoption and usage of DeBank grow, the demand for DBK tokens is expected to increase, leading to potential price appreciation.

Additionally, the platform may introduce mechanisms such as buybacks or burning of tokens to manage the token supply and increase scarcity. These mechanisms, along with the token’s utility within the ecosystem, aim to create a positive feedback loop of value creation for token holders.

- Token supply: 1 billion DBK tokens

- Distribution: Private sale, public sale, team and advisors allocation, ecosystem fund

- Utilization: Staking, governance participation, medium of exchange

- Economic model: Value appreciation, potential mechanisms such as buybacks or burning

In conclusion, DeBank’s tokenomics is built on a fixed token supply, strategic distribution, versatile utilization, and an economic model that aims to create value for token holders. By understanding these aspects, investors and users can have a comprehensive overview of DeBank’s token economy.

The Core Principles of DeBank’s Token Economy

1. Utility: The DeBank token serves as the native currency within the DeBank ecosystem, providing users with a means to access and utilize various services and features. These services and features include staking, governance, borrowing and lending, and liquidity provision.

2. Governance: DeBank token holders have the ability to participate in the decision-making process of the platform through voting and proposing changes to the ecosystem. This ensures that the community has a say in the direction and development of DeBank.

3. Staking and Rewards: By staking their DeBank tokens, users can earn rewards in the form of additional tokens or fees generated by the platform. This incentivizes users to hold and stake their tokens, contributing to the stability and security of the ecosystem.

4. Borrowing and Lending: DeBank token holders can utilize their tokens as collateral to borrow other assets within the DeBank platform. Additionally, users can lend their tokens to earn interest on their holdings, further encouraging participation and liquidity in the ecosystem.

5. Liquidity Provision: DeBank token holders can become liquidity providers by supplying their tokens to the DeBank liquidity pools. These liquidity providers earn fees generated by the platform, creating an additional opportunity for token holders to earn passive income.

6. Community Rewards: DeBank aims to reward active community members by allocating a portion of the revenue generated by the platform to various community programs, initiatives, and incentives. This fosters a sense of community engagement and participation, further strengthening the ecosystem.

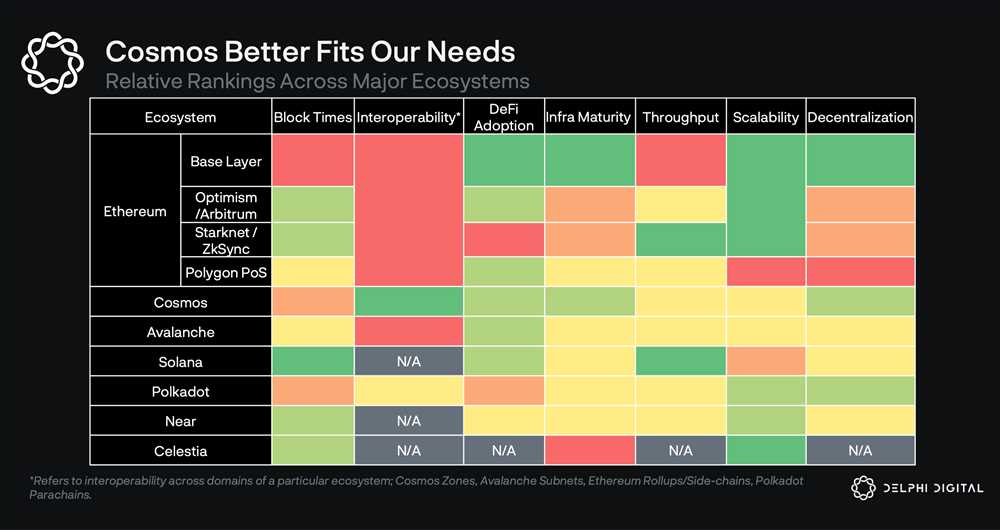

7. Scalability and Interoperability: DeBank’s token economy is designed to be scalable and interoperable with other blockchain networks and platforms. This allows for seamless integration with other DeFi projects, expanding the potential use cases and utility of the DeBank token.

8. Transparency and Trust: DeBank is committed to maintaining a high level of transparency and trust within its token economy. All transactional and operational data within the DeBank ecosystem is publicly verifiable, ensuring that users can have confidence in the integrity and fairness of the platform.

9. Flexibility and Adaptability: The DeBank token economy is designed to be flexible and adaptable to the changing needs and demands of the market. This allows for the introduction of new features, services, and governance mechanisms to ensure the long-term sustainability and growth of the DeBank ecosystem.

10. Security and Auditing: DeBank prioritizes the security of its token economy by implementing robust security measures and conducting regular audits of its smart contracts and systems. This ensures that users’ funds and data are fully protected, providing peace of mind for participants in the ecosystem.

By adhering to these core principles, DeBank aims to create a robust and user-centric token economy that empowers its community members and drives the broader adoption of decentralized finance.

What is DeBank’s tokenomics?

DeBank’s tokenomics refers to the economic model and distribution of its native token. It includes details such as the total supply of tokens, their distribution, token utility, and any mechanisms that drive value or incentivize users.

How does DeBank distribute its tokens?

DeBank distributes its tokens through various methods. A portion of the tokens may be allocated for initial token sales or fundraising rounds, while another portion may be reserved for team members and advisors. Some tokens may also be set aside for community initiatives or incentives for users of the platform.

What is the utility of DeBank’s token?

The utility of DeBank’s token can vary. It may be used as a means of payment within the platform, granting holders access to premium features or services. Additionally, the token may enable users to participate in governance processes, such as voting on proposals or influencing platform decisions.

Are there any mechanisms in place to drive token value?

Yes, DeBank may implement various mechanisms to drive token value. For example, they may employ a token buyback and burn program, where a portion of the platform’s revenue is used to buy and subsequently burn tokens, reducing the overall supply and potentially increasing demand. Additionally, the token may have a staking mechanism that allows users to earn rewards for holding and locking up their tokens.

What are the goals of DeBank’s tokenomics?

The goals of DeBank’s tokenomics can be multi-fold. First and foremost, it aims to create a sustainable and vibrant ecosystem by aligning the interests of token holders, users, and the platform itself. Additionally, it may strive to foster community participation and engagement, facilitate value creation through token appreciation, and provide incentives for long-term token holders.