Decentralized finance (DeFi) has emerged as one of the most promising and revolutionary sectors in the cryptocurrency industry. As traditional financial systems face numerous challenges, DeFi offers a decentralized alternative that empowers individuals to take control of their financial activities. DeBank, a prominent DeFi platform, has gained significant attention for its innovative investment strategy that combines crypto and DeFi assets to achieve impressive returns.

DeBank’s investment strategy revolves around carefully selecting a diverse range of cryptocurrencies and DeFi tokens. By investing in a variety of assets, DeBank aims to mitigate risks and maximize potential gains. The platform conducts in-depth research and analysis to identify promising projects with strong fundamentals, active communities, and innovative solutions. This approach allows DeBank to stay ahead of the curve and leverage opportunities in the ever-evolving crypto and DeFi landscape.

One key aspect of DeBank’s investment strategy is its focus on long-term value creation. Instead of chasing short-term gains, DeBank adopts a patient approach and looks for projects that have the potential to transform the financial industry in the long run. By investing in disruptive technologies and platforms, DeBank aims to support the growth of the decentralized economy and create lasting value for its investors.

Furthermore, DeBank actively embraces decentralized governance models and actively participates in the governance of DeFi protocols. This hands-on approach allows DeBank to have a say in the decision-making process and shape the future direction of the projects it invests in. By engaging with the community and contributing to the development of DeFi ecosystems, DeBank not only strengthens its investment portfolio but also helps foster a more inclusive and decentralized financial system.

In conclusion, DeBank’s investment strategy combines careful research, diversification, and a long-term outlook to build a robust and profitable crypto and DeFi portfolio. By investing in projects with strong fundamentals, embracing decentralized governance, and actively participating in the development of DeFi ecosystems, DeBank is at the forefront of the revolutionized financial landscape, supporting the growth of the decentralized economy and creating value for its investors.

Decoding DeBank’s Investment Strategy

In this article, we will take a closer look at DeBank’s investment strategy and gain insights into their crypto and DeFi portfolio.

DeBank is a leading blockchain analytics and wallet provider that offers a comprehensive suite of financial tools for decentralized finance (DeFi). As an active participant in the crypto space, DeBank has been able to build a strong portfolio by leveraging its expertise and industry knowledge.

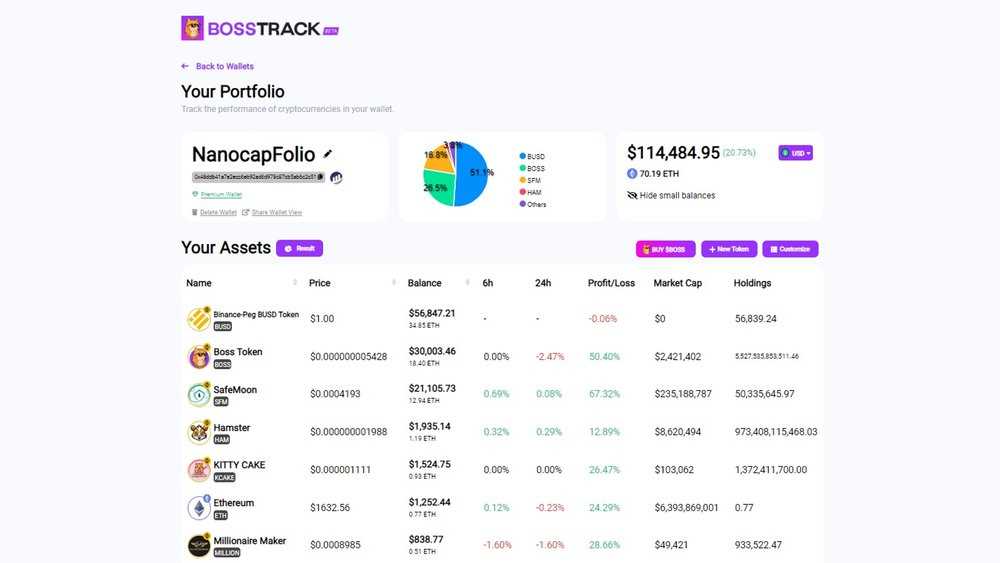

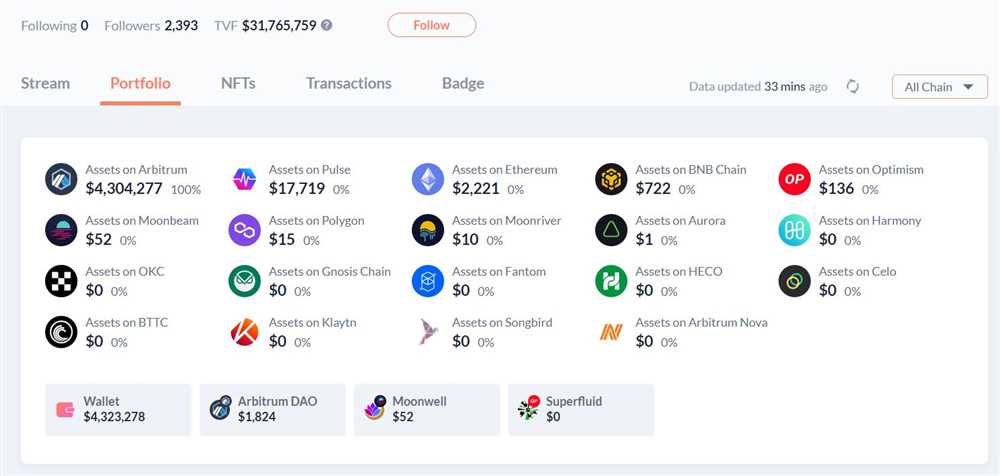

One key aspect of DeBank’s investment strategy is diversification. By investing in a wide range of cryptocurrencies and DeFi projects, DeBank is able to spread its risk and capture opportunities in emerging markets. This approach allows DeBank to take advantage of the high growth potential of certain projects while mitigating the risks associated with individual investments.

In addition to diversification, DeBank also focuses on fundamental analysis when selecting investments. This involves researching and evaluating the underlying technology, team, and market potential of each project. By conducting thorough due diligence, DeBank is able to identify projects with strong fundamentals and promising growth prospects.

Furthermore, DeBank actively monitors the market and keeps a close eye on industry trends and developments. This allows them to identify emerging investment opportunities and adjust their portfolio accordingly. By staying connected to the crypto community and staying informed about the latest innovations, DeBank is able to make informed investment decisions.

Another important aspect of DeBank’s investment strategy is risk management. DeBank employs various risk management techniques, such as position sizing and stop-loss orders, to protect its portfolio from downside risks. By carefully managing its risk exposure, DeBank aims to protect capital and generate consistent returns for its investors.

Overall, DeBank’s investment strategy is centered around diversification, fundamental analysis, market monitoring, and risk management. By following this well-rounded approach, DeBank has been able to build a successful crypto and DeFi portfolio that delivers value to its stakeholders.

Insights into the Crypto and DeFi Portfolio

Decoding DeBank’s investment strategy provides valuable insights into their crypto and DeFi portfolio. By examining their approach, we gain a better understanding of the market trends and areas of interest for one of the leading players in the industry.

1. Diversification is Key

One key insight into DeBank’s portfolio is their emphasis on diversification. They understand the importance of spreading risk across various assets and protocols. By investing in different cryptocurrencies and decentralized finance projects, they minimize the impact of any single investment’s performance on their overall portfolio.

Furthermore, DeBank does not limit themselves to just one type of investment. They actively participate in various aspects of the crypto and DeFi ecosystem, including investments in tokens, liquidity provision, lending and borrowing platforms, and yield farming.

2. Strategic Partnerships and Collaborations

Another insight is the value DeBank places on strategic partnerships and collaborations. They recognize the power of working together with other industry stakeholders to achieve mutually beneficial outcomes. By selectively partnering with promising projects and teams, DeBank taps into their expertise and networks, gaining access to new investment opportunities and staying ahead in the rapidly evolving crypto landscape.

This collaborative approach also helps DeBank to build a robust ecosystem of interconnected projects. By investing in complementary platforms and protocols, they contribute to the growth and sustainability of the broader DeFi ecosystem. This approach strengthens their portfolio and positions them as a key player in the industry.

In addition to partnerships, DeBank actively contributes to the projects they invest in. By providing support and resources, they help these projects achieve their goals and drive innovation in the crypto and DeFi space.

Overall, gaining insights into DeBank’s crypto and DeFi portfolio highlights the importance of diversification and strategic partnerships. These strategies enable them to navigate the rapidly changing market and take advantage of emerging opportunities while managing risk. As the crypto and DeFi space continues to evolve, DeBank’s investment approach serves as a valuable guide for investors looking to make informed decisions and achieve long-term success.

The Rise of DeFi

Decentralized Finance, also known as DeFi, has emerged as one of the hottest trends in the crypto industry. It refers to a new and innovative form of financial services that are built on blockchain technology. Unlike traditional financial systems, DeFi operates in a decentralized manner, eliminating the need for intermediaries like banks and brokers.

DeFi platforms leverage smart contracts, which are self-executing agreements with the terms of the contract directly written into code. These smart contracts enable various financial activities, such as lending, borrowing, trading, and investing, to be performed in a transparent and automated manner.

The rise of DeFi has been fueled by several factors. Firstly, it offers greater accessibility to financial services, especially for the unbanked and underbanked populations. Anyone with an internet connection and a compatible device can easily access and use DeFi platforms.

Secondly, DeFi provides users with greater control over their funds. Since transactions are peer-to-peer and executed on the blockchain, users have full ownership and custody of their assets. This eliminates the need to trust a centralized authority or institution with their funds.

Furthermore, DeFi platforms often offer higher yields and returns compared to traditional financial institutions. Users can earn interest on their crypto assets by participating in lending and borrowing protocols, as well as by providing liquidity to decentralized exchanges. This has attracted many investors and traders to the DeFi space.

The Challenges of DeFi

Despite its rapid growth and popularity, DeFi faces several challenges that need to be addressed. One of the main concerns is the security of smart contracts. While they are designed to be secure and tamper-proof, vulnerabilities and coding errors can still exist, leading to potential exploits and hacks.

Additionally, the user experience of many DeFi platforms still needs improvement. The complexity and technical nature of blockchain and decentralized systems can be daunting for non-technical users. Enhancing the user interface and simplifying processes will be crucial for wider adoption of DeFi.

The Future of DeFi

Despite these challenges, the future of DeFi looks promising. The decentralized nature of DeFi aligns with the ethos of blockchain technology, and its potential impact on the traditional financial system cannot be ignored.

As the technology behind DeFi continues to evolve and mature, we can expect to see more sophisticated financial products and services being built on decentralized platforms. This will further disrupt and democratize the financial industry, giving individuals more control over their financial lives.

| Advantages | Disadvantages |

|---|---|

| Greater accessibility | Security concerns |

| Increased control over funds | Complex user experience |

| Higher yields and returns |

Overall, the rise of DeFi signifies a shift towards a more inclusive and decentralized financial system. It has the potential to transform the way we access and interact with financial services, paving the way for a more fair, transparent, and accessible future.

What is DeBank’s investment strategy?

DeBank’s investment strategy focuses on the crypto and DeFi sectors. The company aims to invest in projects and protocols that have strong potential for growth and offer innovative solutions in the decentralized finance space.

What are some examples of projects in DeBank’s portfolio?

Some projects in DeBank’s portfolio include Ethereum, Compound, Aave, Chainlink, and Uniswap. These projects are considered to be leaders in the DeFi space and have shown strong performance and adoption.