Discover the secrets behind DeBank’s incredible funding success and find out how you can apply these strategies to your own business.

Have you ever wondered how some companies seem to effortlessly secure funding, while others struggle to make ends meet?

At DeBank, we have cracked the code to funding success, and now we’re ready to share our insights with you. Our revolutionary approach has allowed us to secure millions in funding, propelling us to become a leader in the industry.

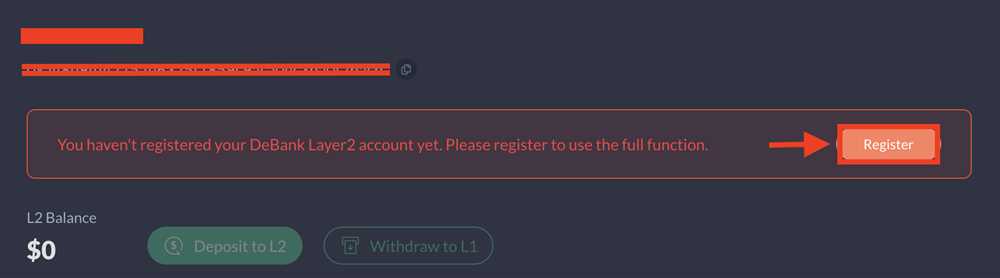

Join our exclusive webinar and learn from the experts themselves. During this one-hour session, our CEO will reveal the key strategies that have made DeBank a funding powerhouse.

Discover how to craft a compelling pitch, identify the right investors, and position your company for success. Whether you’re a startup looking for seed funding or an established business seeking expansion capital, this webinar is a must-attend event.

Don’t miss out on this unique opportunity to learn from the best! Register now for our upcoming webinar and take the first step towards securing the funding your business deserves.

DeBank’s Funding Success

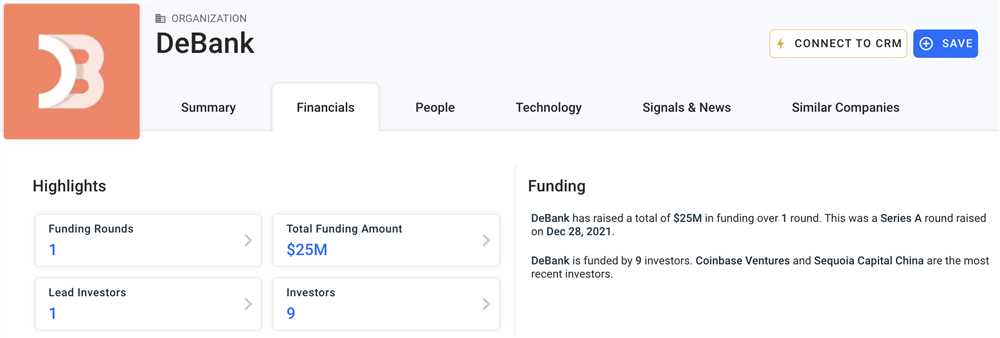

When it comes to funding success, DeBank is a shining example in the financial industry. With innovative products and services, they have managed to secure substantial investments and create a strong foundation for future growth.

One of the key factors behind DeBank’s funding success is their focus on delivering value to their customers. By providing tailored solutions to meet the unique needs of each client, they have established a reputation for excellence.

Another contributing factor is DeBank’s commitment to transparency and trust. They have always kept their clients informed about their financial health and performance, which has built a strong bond of trust between the company and its stakeholders.

Furthermore, DeBank’s team of experienced professionals has played a crucial role in their funding success. The team’s expertise in the financial industry and their ability to adapt to market changes has allowed DeBank to stay ahead of the competition.

Additionally, DeBank’s strong network of partners and investors has provided them with ample opportunities for growth and expansion. By leveraging these partnerships, they have been able to access new markets and secure additional funding.

In conclusion, DeBank’s funding success can be attributed to their focus on delivering value, commitment to transparency and trust, the expertise of their team, and their strong network of partners and investors. As they continue to innovate and evolve, DeBank is set to achieve even greater success in the future.

Key Insights

During DeBank’s Funding Success, several key insights were gained that can benefit other businesses and entrepreneurs. These insights include:

1. Clear Value Proposition

One of the main reasons for DeBank’s funding success was its clear and compelling value proposition. The company was able to clearly communicate the problems it was solving and the unique features of its product or service. This made it easier for potential investors to understand the value of the offering and the potential for growth.

2. Strong Market Opportunity

Another key insight was the identification of a strong market opportunity. DeBank was able to demonstrate that there was a significant market need for its product or service and that it had a competitive advantage in addressing this need. This helped to build confidence among investors and increase the likelihood of funding success.

3. A Solid Business Plan

In addition, DeBank had a solid business plan that outlined its strategy for growth and profitability. This included a clear financial projection, a detailed marketing plan, and a thorough analysis of the competitive landscape. Having a well-thought-out and comprehensive business plan helped to build trust and credibility with potential investors.

4. Team Expertise

The expertise and experience of DeBank’s team also played a crucial role in its funding success. The company had a team of highly skilled professionals with a strong track record in the industry. This helped to instill confidence in investors that the team had the necessary expertise to execute on the business plan and drive growth.

Overall, these key insights highlight the importance of a clear value proposition, a strong market opportunity, a solid business plan, and a skilled team in achieving funding success for businesses and entrepreneurs.

Lessons to Be Learned

DeBank’s Funding Success offers valuable lessons for aspiring entrepreneurs and businesses seeking investment. Here are some key takeaways:

1. Create a Solid Business Plan

A well-structured and comprehensive business plan is essential when seeking funding. It should outline your goals, target market, competitive analysis, and financial projections. Investors want to see that you have a clear vision for your business and a realistic plan for achieving it.

2. Build a Strong Network

Networking is crucial for connecting with potential investors and industry experts. Attend industry events, join professional organizations, and actively engage on relevant social media platforms. Building relationships and gaining industry insights can open doors to funding opportunities.

Additionally, consider seeking out mentorship or advisory services from experienced professionals who can provide guidance and connections.

3. Customize Your Approach

When approaching investors, tailor your pitch to their specific interests and investment criteria. Research their past investments and align your value proposition with their portfolio. Personalize your message to demonstrate that you understand their needs and how your business aligns with their goals.

4. Be Transparent and Authentic

Honesty and authenticity are key when presenting your business to potential investors. Clearly communicate your strengths, weaknesses, and risks. Investors appreciate transparency and want to understand the challenges and opportunities associated with your venture.

5. Demonstrate Market Potential

Investors want to see that your product or service has a sizable and growing market. Conduct thorough market research and present compelling data and insights. Highlight your competitive advantage and explain how you plan to capture and retain market share.

6. Showcase a Strong Team

Investors often invest in the people behind the business. Highlight the qualifications and expertise of your team members. Show that you have a cohesive and capable team that can execute your business plan and navigate challenges effectively.

7. Prepare for Due Diligence

When a potential investor shows interest, be prepared for due diligence. Have all necessary legal and financial documents organized and readily available. Be responsive and proactive in providing additional information as requested. A well-prepared and organized approach can instill investor confidence.

By incorporating these lessons into your fundraising strategy, you can increase your chances of securing funding and turning your business dreams into reality.

What is DeBank’s Funding Success?

DeBank’s Funding Success is a report that analyzes the funding strategies and successes of DeBank, a financial technology startup company. It provides insights and lessons that other startups and entrepreneurs can learn from to secure funding for their own ventures.

Why is DeBank’s Funding Success important?

DeBank’s Funding Success is important because it offers valuable insights and lessons for startups and entrepreneurs looking to secure funding. By studying the strategies and successes of DeBank, they can learn from their experiences and apply similar tactics to increase their chances of successfully raising capital.

What can we learn from DeBank’s Funding Success?

From DeBank’s Funding Success, we can learn various lessons such as the importance of having a clear and compelling pitch, building a strong network of investors and advisors, demonstrating market demand and potential, and effectively communicating the value proposition of the business. These lessons can help aspiring entrepreneurs navigate the funding landscape and increase their chances of securing investment.