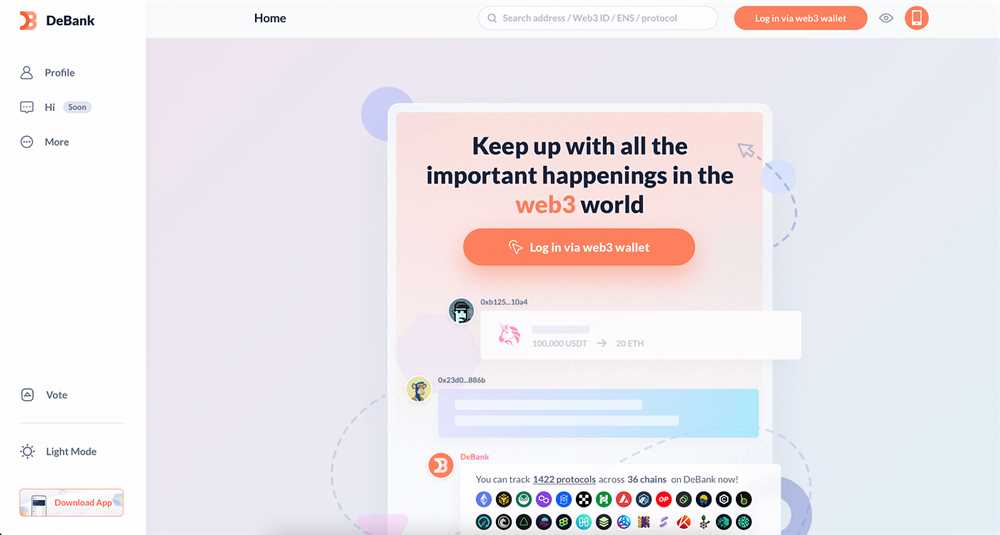

Managing personal finances can be a complex task, especially in today’s fast-paced world where financial transactions occur at the click of a button. Thankfully, with the advent of modern technology, various tools and applications have been developed to assist individuals in managing their finances efficiently. One such tool that has gained popularity in recent times is the DeBank helper.

DeBank helper is a comprehensive financial management tool that offers a wide range of features to help users gain better control over their financial health. Whether you are an individual looking to track your expenses, a business owner managing multiple accounts, or a professional seeking to optimize your investment portfolio, DeBank helper has something to offer.

One of the key benefits of using DeBank helper is its user-friendly interface. The application is designed with simplicity in mind, making it easy for users of all technical backgrounds to navigate and utilize its features. Whether you are a tech-savvy individual or someone who is not too familiar with technology, the DeBank helper provides an intuitive and seamless user experience.

Another advantage of using DeBank helper is its advanced financial tracking capabilities. The application allows users to link their bank accounts, credit cards, and other financial accounts to consolidate all their transactions in one place. This enables users to easily track their income, expenses, and savings, providing them with a comprehensive overview of their financial status.

Improved financial organization

DeBank helper offers a range of features that can greatly improve your financial organization. With its intuitive interface, you can easily manage all aspects of your finances in one place.

Budgeting made easy

One of the key benefits of using DeBank helper is its powerful budgeting tools. You can create a personalized budget based on your income and expenses, set budget goals, and track your progress. The app provides visual representations of your spending habits, making it easy to identify areas where you can cut back or save.

Expense tracking and categorization

DeBank helper allows you to effortlessly track and categorize your expenses. The app automatically syncs with your bank accounts and credit cards, retrieving all your transactions. You can then categorize each expense, making it easier to spot patterns and trends in your spending.

The app also allows you to set spending limits for specific categories. This feature helps you stay on track and avoid overspending.

Financial goal setting

DeBank helper enables you to set and track your financial goals. Whether it’s saving for a vacation, paying off debt, or investing in your future, the app provides tools to help you stay focused and motivated.

By visualizing your progress and providing reminders, the app helps you stay on track and achieve your financial goals.

Overall, DeBank helper makes it easier than ever to stay organized with your finances. With its user-friendly interface and powerful tools, you can take control of your money and achieve your financial goals more efficiently.

Enhanced budgeting capabilities

DeBank helper offers enhanced budgeting capabilities that can greatly assist you in managing your finances more effectively.

With DeBank helper, you can set up personalized budgets for different categories such as groceries, dining out, entertainment, and more. The tool allows you to track your expenses and compare them to your budget to ensure you stay within your financial goals.

By providing you with detailed insights and reports, DeBank helper helps you make informed decisions about your spending habits. You can identify areas where you are overspending and make necessary adjustments to ensure you are saving and investing in the right places.

In addition to setting up budgets and tracking expenses, DeBank helper also provides features such as notifications and reminders. You can receive alerts when you are nearing your budget limits or when you have upcoming bills to pay, helping you stay on top of your financial obligations.

Whether you are trying to save for a big purchase, pay off debt, or simply manage your day-to-day expenses, DeBank helper’s enhanced budgeting capabilities give you the tools you need to achieve your financial goals.

Streamlined expense tracking

Managing expenses can be a time-consuming task, but with DeBank helper, it becomes a streamlined process. The financial management tool offers an easy way to track your expenses, helping you stay organized and in control of your finances.

With DeBank helper, you can easily input your expenses and categorize them, making it simple to see where your money is going. The tool provides visual charts and graphs that give you a clear view of your spending habits.

Additionally, DeBank helper allows you to set budget goals and track your progress in real-time. You can easily see if you are overspending in a certain category and make adjustments accordingly.

DeBank helper also offers features like receipt scanning, which allows you to snap a photo of your receipt and upload it directly into the app. This eliminates the need for manual data entry and makes expense tracking even more efficient.

By using DeBank helper for expense tracking, you can save time and make better financial decisions. With its user-friendly interface and powerful features, it’s an invaluable tool for managing your finances.

Easier financial goal setting

Setting financial goals is an essential part of managing your finances effectively. It helps you stay focused and motivated, and enables you to make strategic decisions to achieve your desired financial outcomes. With the help of DeBank helper, setting financial goals becomes easier than ever.

DeBank helper provides you with a user-friendly interface that allows you to easily set and track your financial goals. You can start by defining specific goals that are important to you, whether it’s saving for retirement, buying a house, or paying off debt.

Personalized Goals

DeBank helper tailors the goal-setting process to your individual needs and circumstances. It takes into account factors such as your income, expenses, and savings to generate personalized recommendations for achievable financial goals.

By analyzing your financial data, DeBank helper provides insights and suggestions to help you create realistic goals that align with your current financial situation. This personalized approach gives you a clearer understanding of what it takes to reach your goals and helps you stay motivated throughout the process.

Progress Tracking

One of the key benefits of using DeBank helper for financial goal setting is its progress tracking feature. The platform allows you to monitor your progress towards your goals in real-time.

You can easily track your income, expenses, and savings within the app, making it convenient to see how much closer you are to achieving your goals. This visibility empowers you to make informed decisions about your spending habits and adjust your financial strategy if needed.

Additionally, DeBank helper provides visual representations of your progress, such as charts and graphs, that make it easy to understand and interpret your financial data. This visual feedback not only helps you stay motivated but also enables you to identify areas for improvement.

In conclusion, DeBank helper simplifies the process of setting and achieving financial goals. Its user-friendly interface, personalized recommendations, and progress tracking feature make it easier than ever to manage your finances effectively and work towards a secure financial future.

Increased financial security

One of the key benefits of using DeBank helper for financial management is the increased financial security it provides. With the rising threat of online fraud and identity theft, it is important to take measures to protect your financial information.

By using DeBank helper, you can securely manage all your financial accounts in one place. The platform uses state-of-the-art encryption technology to ensure that your data is protected against unauthorized access.

In addition, DeBank helper provides real-time alerts for any unusual activity, such as unrecognized transactions or suspicious logins. This allows you to quickly identify and resolve any potential security breaches.

Securely store and access passwords

DeBank helper also offers a secure password manager feature. This means that you no longer need to remember multiple complex passwords for all your financial accounts. Instead, you can securely store all your passwords in one place.

The password manager uses advanced encryption to protect your passwords from being compromised. Additionally, the platform allows you to conveniently auto-fill login forms, saving you time and reducing the risk of password theft.

With DeBank helper, you can also generate strong and unique passwords for each of your accounts. This adds an extra layer of protection against hackers and ensures that even if one account is compromised, your other accounts remain secure.

Monitor your credit score

Your credit score plays a crucial role in your financial well-being. DeBank helper offers a feature that allows you to monitor your credit score on a regular basis. This helps you stay informed about any changes that may impact your creditworthiness.

By keeping a close eye on your credit score, you can quickly identify any discrepancies or errors and take action to rectify them. This proactive approach can help safeguard your financial reputation and prevent unauthorized access to your credit information.

Overall, using DeBank helper for financial management provides increased financial security by offering secure storage of passwords, real-time alerts for unusual activity, and the ability to monitor your credit score. By taking advantage of these features, you can have peace of mind knowing that your financial information is safe and protected.

What is DeBank helper?

DeBank helper is a financial management tool that aims to help users manage their finances more effectively. It provides a range of features and functionalities to track expenses, set budgets, and analyze spending patterns.

What are the benefits of using DeBank helper?

There are several benefits of using DeBank helper for financial management. Firstly, it allows users to have a clear overview of their financial situation by tracking their income and expenses. This helps in identifying areas where they can cut costs or save money. Secondly, it enables users to set budgets and monitor their spending against these budgets. This helps in controlling expenses and avoiding overspending. Lastly, DeBank helper provides advanced analytics and insights into spending patterns, helping users make more informed financial decisions.

How can DeBank helper help me save money?

DeBank helper can help you save money in several ways. Firstly, it allows you to track your expenses and identify areas where you can cut costs. By having a clear overview of your spending patterns, you can make adjustments and save money. Secondly, DeBank helper enables you to set budgets and monitor your spending against these budgets. This helps in controlling expenses and avoiding unnecessary purchases. Lastly, DeBank helper provides insights and analytics that can help you make more informed financial decisions, which can ultimately lead to saving money.

Is DeBank helper available for mobile devices?

Yes, DeBank helper is available for both iOS and Android devices. It can be downloaded from the respective app stores and installed on your mobile device. This allows you to manage your finances on the go and have access to your financial data anytime, anywhere.