Discover cutting-edge alternatives to Debank and stay one step ahead in the digital finance world.

Are you tired of the same old banking options? Looking for fresh and innovative solutions to manage your finances securely and efficiently?

Introducing the latest Debank alternatives that are revolutionizing the way we think about banking. With their advanced features and user-friendly interfaces, these alternatives are taking the financial industry by storm.

Stay in control of your financial future with these game-changing options. Experience seamless transactions, comprehensive financial planning tools, and unbeatable security measures.

Don’t settle for outdated banking solutions. Embrace the new era of digital finance and discover the alternative options that are reshaping the industry.

Don’t wait, join the revolution and explore the latest Debank alternatives today!

The Rise of Debank Alternatives

In today’s fast-paced and competitive world, staying ahead of the game is crucial. As traditional banking systems struggle to keep up with the demands of modern consumers, a new wave of debank alternatives has emerged.

Gone are the days of waiting in line at the bank or dealing with outdated and convoluted processes. Debank alternatives offer a more streamlined and efficient way to manage your financial needs.

The Benefits of Debank Alternatives

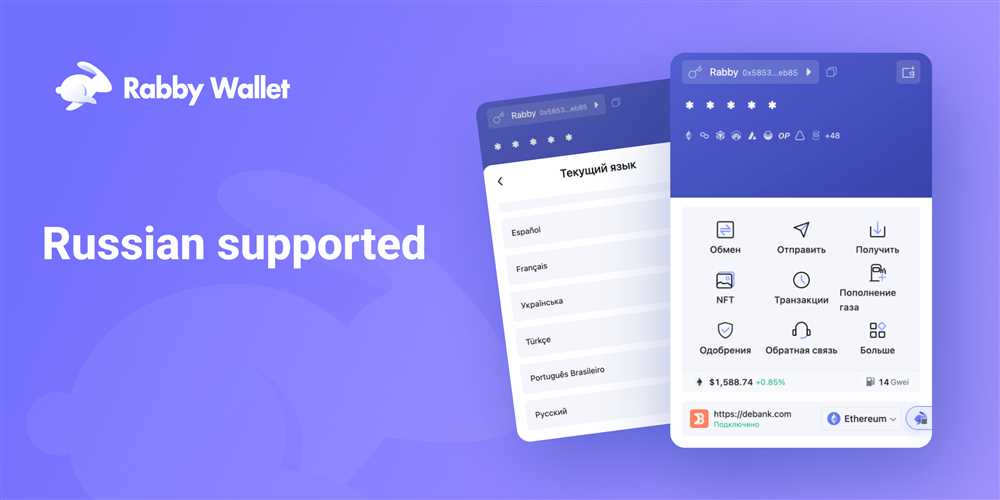

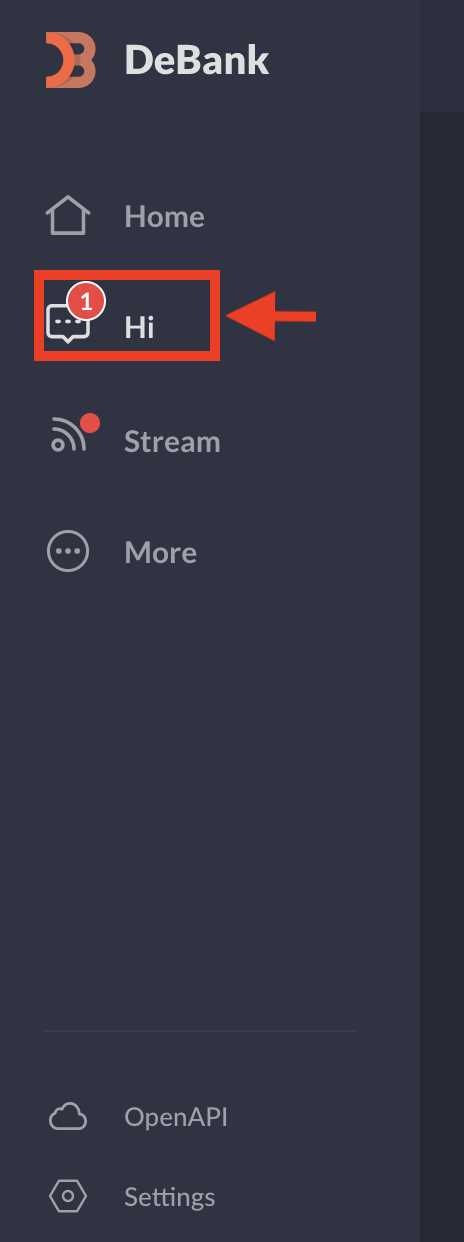

One of the key advantages of debank alternatives is their user-friendly interfaces. With intuitive apps and platforms, managing your finances has never been easier. Whether you’re tracking your expenses, setting budgets, or making payments, the process is seamless and hassle-free.

Another major benefit is the flexibility that debank alternatives provide. Unlike traditional banks, which often have strict requirements and regulations, debank alternatives are more lenient. They understand that everyone’s financial situation is unique and cater to a wide range of customers.

Embracing the Future of Banking

As technology continues to advance at a rapid pace, the banking industry must adapt or risk becoming obsolete. Debank alternatives are at the forefront of this evolution, harnessing the power of digital innovation to revolutionize the way we bank.

Whether you’re a millennial looking for a more tech-savvy and convenient solution or a business owner in need of faster and more efficient banking services, debank alternatives have got you covered. Stay ahead of the game and explore the latest debank alternatives today!

The Evolution of Debanking

Debanking has come a long way since its inception. In the early days, it was simply a term used to describe the process of removing oneself from traditional banking institutions and embracing alternative financial solutions. However, as technology advanced and new opportunities arose, debanking evolved into something much more comprehensive and sophisticated.

A Shift Towards Digital

With the advent of the internet and digital technology, debanking became increasingly focused on providing users with online platforms and applications. This shift allowed individuals to have greater control over their finances, with the ability to manage accounts, make payments, and access financial services from the comfort of their own homes or on the go.

The Rise of Fintech

The rise of fintech companies played a significant role in the evolution of debanking. These innovative startups leveraged technology to disrupt traditional banking by offering a wide range of financial services and solutions. Fintech companies introduced new concepts such as peer-to-peer lending, mobile banking, and digital wallets, providing users with greater flexibility and convenience.

As the fintech industry continued to grow, it paved the way for alternative financial solutions that were more inclusive and accessible. This meant that individuals who were previously underserved or excluded from traditional banking systems could now access financial services tailored to their specific needs.

Blockchain and Decentralization

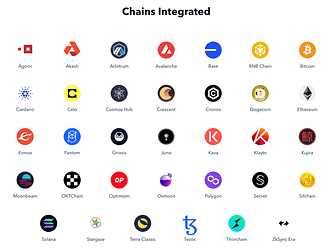

One of the most significant developments in debanking has been the emergence of blockchain technology and decentralized finance (DeFi). Blockchain technology, with its distributed ledger system and cryptographic security, has introduced new levels of transparency and trust to financial transactions.

DeFi platforms have taken this a step further, allowing users to access a wide range of financial services without the need for intermediaries or centralized institutions. Through smart contracts and decentralized apps, individuals can now participate in lending, borrowing, trading, and investing activities with greater security and autonomy.

The Future of Debanking

The evolution of debanking is far from over. As technology continues to advance, we can expect further innovation in the field of finance. The integration of artificial intelligence and machine learning, for example, holds the promise of more personalized and intelligent financial solutions.

Additionally, the rise of cryptocurrencies and digital assets will likely play a significant role in reshaping the financial landscape. With the increasing acceptance and adoption of cryptocurrencies, it is becoming clear that traditional banking and debanking will need to coexist, offering users a diverse range of options and possibilities.

In conclusion, debanking has evolved from a simple concept to a comprehensive and dynamic industry. With the advancements in technology and the changing needs of individuals, debanking will continue to evolve, offering users greater control, flexibility, and inclusivity in managing their finances.

The Need for Alternatives

Debank has been a popular choice among users for managing their finances and investments. However, as the market evolves, the need for alternatives becomes evident. Here are a few reasons why exploring the latest Debank alternatives is essential:

- Increased competition: With the rise of digital banking and fintech startups, the market is becoming more competitive. By exploring and considering alternatives, you can stay ahead of the game and find better solutions that suit your needs.

- Advanced features: While Debank may offer great features, alternative platforms can sometimes provide even more advanced functionalities. By exploring different options, you can discover new features that can enhance your financial management experience.

- Lower fees: Although Debank may have competitive pricing, alternative platforms often offer lower fees and better pricing structures. By diversifying your options, you have the potential to save money on transaction fees, account maintenance, and more.

- Improved security: As technology advances, so do the risks associated with online financial management. Exploring alternatives allows you to find platforms that prioritize data protection, encryption, and other security measures to ensure the safety of your information.

- Better customer support: While Debank may provide solid customer support, alternative platforms can sometimes offer a more personalized and efficient customer service experience. By exploring alternatives, you have the opportunity to find platforms that are dedicated to providing exceptional support to their users.

In conclusion, staying ahead of the game in managing your finances requires exploring the latest Debank alternatives. By considering factors such as competition, advanced features, lower fees, improved security, and better customer support, you can find the platform that best suits your needs and priorities.

What is Debank?

Debank is a decentralized platform that allows users to track their cryptocurrency investments and manage their portfolios. It provides real-time data on prices, balances, and transactions across multiple blockchains, making it easy for users to stay updated on their crypto assets.

What are the alternatives to Debank?

There are several alternatives to Debank, each offering different features and functionality. Some popular alternatives include Blockfolio, CoinTracking, and Delta. Blockfolio is a mobile app that allows users to track their cryptocurrency investments and receive price alerts. CoinTracking is a web-based platform that offers portfolio tracking, tax reporting, and analysis tools. Delta is a mobile app that offers similar features to Debank, including portfolio tracking and price alerts.