In recent months, there has been widespread concern about the security of DeBank, an emerging online banking platform. Rumors and speculations questioning DeBank’s ability to protect users’ sensitive information have caused unease among potential users. However, it is crucial to separate fact from fiction and delve into the measures that DeBank has implemented to maintain a robust security infrastructure.

First and foremost, encryption is at the heart of DeBank’s security framework. All user data, including personal information and financial details, is encrypted using cutting-edge algorithms. This means that even if unauthorized individuals gain access to the system, the information they obtain will be indecipherable and useless. By employing such sophisticated encryption methods, DeBank ensures that users’ data remains secure and protected from prying eyes.

Additionally, DeBank has implemented stringent access control measures to prevent unauthorized access to its platform. Multiple layers of security, including firewalls and intrusion detection systems, are in place to monitor and filter incoming traffic. Moreover, DeBank employs sophisticated authentication protocols, such as two-factor authentication, to verify user identity and ensure that only authorized individuals can access their accounts. These measures significantly reduce the risk of unauthorized access and enhance the overall security of the platform.

Debunking Misinformation: Clarifying DeBank’s Security Measures

There has been some misinformation circulating regarding the security measures implemented by DeBank, and we feel it is important to clarify these concerns. We understand the need for transparency when it comes to the safety of your funds, so we want to address any confusion and debunk any false claims.

State-of-the-Art Encryption

One of the key aspects of DeBank’s security measures is our state-of-the-art encryption. We employ the latest encryption technology to protect your sensitive data, ensuring that it is secure and inaccessible to unauthorized parties. This encryption is used both during the transmission of data and while storing it in our systems.

Multi-Factor Authentication

Another essential security feature offered by DeBank is multi-factor authentication. We understand that passwords alone might not be enough to prevent unauthorized access, which is why we have implemented an additional layer of security. With multi-factor authentication, you can add an extra step to the login process, such as a unique code sent to your registered mobile device, making it much harder for someone to gain access to your account.

| Security Measure | Explanation |

|---|---|

| Regular Security Audits | DeBank conducts regular and thorough security audits to identify any potential vulnerabilities in our systems. These audits help to strengthen our security measures and ensure that our users’ funds are well protected. |

| Secure Storage | We take the security of your funds seriously, which is why we store the majority of users’ funds in offline, cold storage wallets. These wallets are not connected to the internet, making them less susceptible to hacking attempts. |

| Transparent Bug Reporting | If you discover a potential security vulnerability, we encourage you to report it to us through our bug bounty program. We value the input of our users and are committed to addressing any issues promptly and transparently. |

We hope this clarifies any misconceptions you may have had regarding DeBank’s security measures. We prioritize the safety of our users’ funds and are continuously working to enhance our security protocols. If you have any further questions or concerns, please do not hesitate to reach out to our support team. Your trust in DeBank is highly appreciated, and we remain committed to providing a secure platform for all your financial needs.

Risk Assessment: Evaluating DeBank’s Vulnerabilities

As a leading financial institution, DeBank understands the importance of maintaining top-level security for its users. However, it is important to conduct a thorough risk assessment to identify any potential vulnerabilities in order to address them effectively. By evaluating DeBank’s security measures, we can gain a better understanding of the risks involved and take appropriate actions to mitigate them.

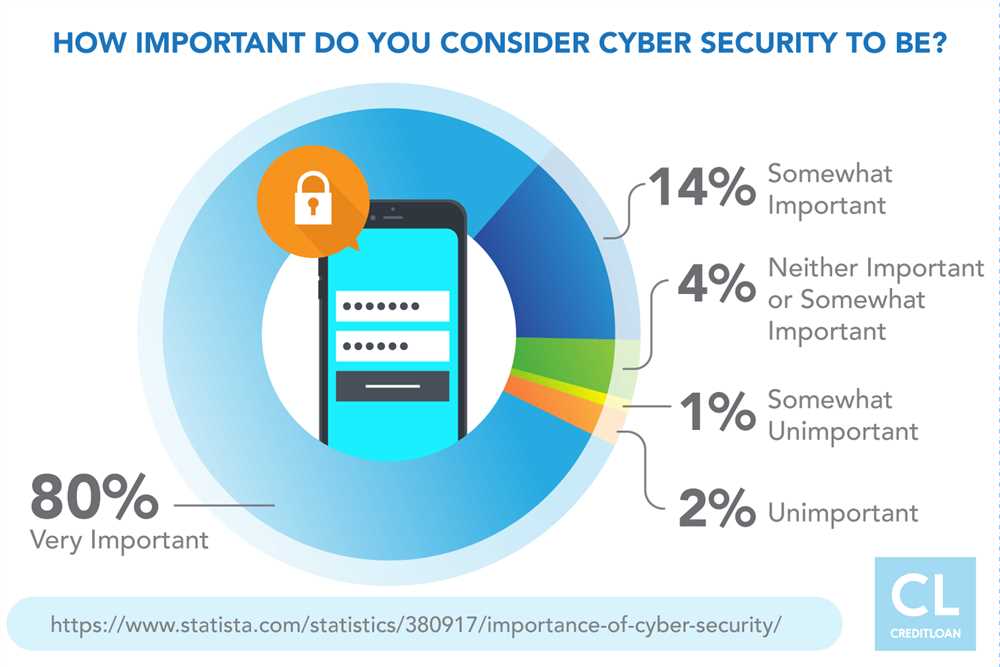

Evaluating External Threats

One aspect of the risk assessment involves evaluating external threats that may pose a risk to DeBank’s security. This includes potential cyber attacks, hacking attempts, and unauthorized access to sensitive user data. By analyzing the current state of cybersecurity and staying updated with the latest trends in the industry, DeBank can ensure it is equipped to defend against potential external threats.

Analyzing Internal Processes

In addition to external threats, evaluating internal processes is also crucial in assessing vulnerabilities. This involves examining the ways in which user data is stored, transmitted, and accessed within DeBank’s system. By conducting regular audits and implementing strict access controls, DeBank can minimize the risk of internal breaches and unauthorized access.

Implementing Multi-layered Security Measures

To further enhance security, DeBank must adopt a multi-layered approach to protect user information. This includes implementing encryption protocols, multi-factor authentication, and ongoing monitoring of network traffic. By implementing these security measures, DeBank can ensure that even if one layer is compromised, there are additional layers of protection in place.

Regular Testing and Updates

Regularly testing and updating DeBank’s security measures is essential in identifying and addressing vulnerabilities. Continuous monitoring and threat assessments can help identify any emerging risks and allow for prompt remediation. Staying updated with software patches, security protocols, and industry best practices is essential in maintaining a strong defense against evolving threats.

Education and Awareness

Lastly, DeBank should prioritize education and awareness among its employees and users. This includes providing training on best security practices, raising awareness about phishing attempts, and promoting strong password policies. By fostering a culture of security awareness, DeBank can minimize the risk of human error and ensure that all individuals involved are actively contributing to a secure environment.

By conducting a comprehensive risk assessment and addressing vulnerabilities, DeBank can enhance its security measures and instill confidence in its users. With proactive measures in place, DeBank can continue to provide a safe and secure financial platform for its customers.

Security Framework: Exploring DeBank’s Robust System

Ensuring the security of user funds and data is of paramount importance for DeBank. We have designed and implemented a robust security framework to protect against potential threats and vulnerabilities.

1. Multi-factor Authentication

DeBank employs a multi-factor authentication system to verify the identity of users. This adds an extra layer of security by requiring users to provide multiple pieces of evidence to gain access to their accounts.

2. End-to-end Encryption

All communication between DeBank’s servers and user devices is protected by end-to-end encryption. This ensures that data transmitted over the internet is securely encrypted and cannot be intercepted or tampered with by unauthorized parties.

3. Cold Storage

DeBank stores the majority of user funds in cold storage wallets, which are offline and not accessible via the internet. This provides an additional layer of protection against hacking and online attacks.

4. Regular Audits

We regularly conduct security audits to identify and address vulnerabilities in our system. External security experts are hired to perform comprehensive audits and penetration tests to ensure that our infrastructure meets the highest security standards.

5. Strong Password Requirements

DeBank enforces strong password requirements, including a minimum length and a combination of uppercase and lowercase letters, numbers, and special characters. This helps to prevent brute-force attacks and ensures that user accounts are adequately protected.

6. Data Backup

All user data is regularly backed up to prevent loss in the event of a system failure or data breach. These backups are securely stored and can be used to restore user accounts to a previous state if necessary.

7. SSL/TLS Certificates

DeBank’s website and mobile applications are secured with SSL/TLS certificates. This encrypts data transmitted between users and our servers, protecting sensitive information from unauthorized access.

8. Bug Bounty Program

To encourage responsible security research and to identify potential vulnerabilities, DeBank has implemented a bug bounty program. This program rewards individuals who responsibly disclose security vulnerabilities and weaknesses in our system.

| Security Measures | Description |

|---|---|

| Firewall Protection | We have implemented a robust firewall to monitor and filter incoming and outgoing network traffic, preventing unauthorized access to our servers. |

| Two-Factor Authentication | In addition to multi-factor authentication, we also offer two-factor authentication for an extra layer of security. Users can enable this feature to receive a unique code on their mobile device, which they need to provide during the login process. |

| Regular Security Updates | We constantly monitor and update our system with the latest security patches and fixes to address any known vulnerabilities and protect against emerging threats. |

By implementing these security measures, DeBank strives to create a secure environment for users to manage their finances and transact with peace of mind.

What are the main security concerns related to DeBank?

There are several main security concerns related to DeBank. First, users are worried about the safety of their personal information, such as their account details and transaction history. Second, there are concerns about the potential for hacking or theft of funds from users’ wallets. Finally, users are also concerned about the possibility of DeBank itself being compromised and their funds being at risk.

How does DeBank address the security concerns?

DeBank takes several steps to address the security concerns. First, they use advanced encryption protocols to protect users’ personal information and ensure its confidentiality. Second, they implement robust security measures to safeguard users’ wallets and funds, such as multi-factor authentication and cold storage for assets. Finally, DeBank regularly conducts security audits and employs a team of experts to monitor and respond to potential security threats.

Has DeBank experienced any security breaches or incidents in the past?

No, DeBank has not experienced any security breaches or incidents in the past. They have a strong track record of maintaining the security of their platform and keeping users’ funds safe. However, it’s important to note that no system is completely immune to security risks, and DeBank continuously enhances their security measures to stay ahead of potential threats.