Welcome to the world of decentralized finance (DeFi)! If you’re looking to maximize your returns and dive into the exciting world of cryptocurrencies, the DeBank Crypto & DeFi Portfolio 4+ is just what you need. This portfolio offers a range of carefully selected cryptocurrencies and DeFi tokens that have the potential to generate significant profits. Whether you’re a seasoned investor or just starting out, this portfolio can help you take advantage of the booming crypto market.

What sets the DeBank Crypto & DeFi Portfolio 4+ apart is its focus on high-performing assets in the DeFi space. DeFi has gained immense popularity in recent years, offering innovative financial solutions that are disrupting traditional banking systems. By investing in this portfolio, you’ll have exposure to some of the most promising DeFi projects, giving you the opportunity to benefit from their growth.

But how can you maximize your returns with this portfolio? It’s all about strategy. Diversification is key when it comes to investing in cryptocurrencies and DeFi tokens. The DeBank Crypto & DeFi Portfolio 4+ offers a balanced mix of high-cap cryptocurrencies and smaller, up-and-coming projects. By spreading your investments across different assets, you’ll be able to mitigate risk and potentially tap into the next big thing in the crypto world.

In addition to diversification, staying informed about the market is crucial. The cryptocurrency market is highly volatile, which means prices can fluctuate rapidly. Keeping track of news, market trends, and project developments can help you make informed decisions and adjust your portfolio accordingly. The DeBank Crypto & DeFi Portfolio 4+ provides you with access to in-depth analysis and market insights, empowering you to make the best investment choices.

So, if you’re ready to maximize your returns and benefit from the explosive growth of cryptocurrencies and DeFi, the DeBank Crypto & DeFi Portfolio 4+ is the perfect tool for you. With its carefully curated selection of assets and strategic approach, this portfolio can help you navigate the complex world of crypto investing and potentially unlock significant profits. Get started today and embark on your journey to financial freedom with DeBank!

Understanding the DeBank Crypto & DeFi Portfolio 4+

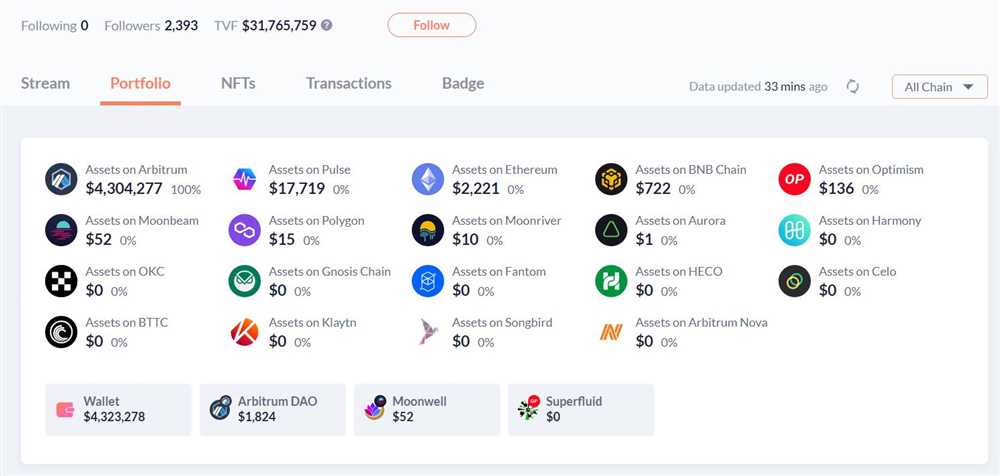

The DeBank Crypto & DeFi Portfolio 4+ is a comprehensive investment tool that allows users to maximize their returns in the world of decentralized finance. This portfolio is designed to provide users with a diversified range of investment options in the crypto space, allowing them to take advantage of various opportunities and minimize risks.

Diversification and Risk Management

One of the key features of the DeBank Crypto & DeFi Portfolio 4+ is its emphasis on diversification. By investing in a wide range of cryptocurrencies and DeFi projects, users are able to spread their risk and reduce the potential impact of any single investment. This helps to protect against market volatility and increase the chances of achieving positive returns.

Additionally, the portfolio is carefully constructed to manage risk by investing in a mix of established cryptocurrencies as well as emerging projects. This provides users with exposure to both low-risk, stable investments and high-potential, higher-risk investments.

Regular Portfolio Updates

The DeBank Crypto & DeFi Portfolio 4+ is regularly updated to reflect the rapidly evolving nature of the crypto market. The portfolio managers closely monitor market trends, news, and developments to ensure that the portfolio remains optimized for maximum returns. Users can expect regular updates and adjustments to the portfolio composition based on the latest market insights and opportunities.

Active Portfolio Management

The DeBank Crypto & DeFi Portfolio 4+ is actively managed by a team of experienced professionals who have a deep understanding of the crypto and DeFi space. These portfolio managers conduct thorough research and analysis to identify investment opportunities that align with the portfolio’s objectives and risk profile.

The active management of the portfolio allows for quick response to market changes and the ability to take advantage of emerging opportunities. The portfolio managers are committed to achieving the best possible returns for users by implementing effective investment strategies based on their expertise and market insights.

Educational Resources and Support

The DeBank Crypto & DeFi Portfolio 4+ is not only a tool for investment, but also a platform for education. Users can access a range of educational resources such as articles, videos, and tutorials that help them understand the various aspects of the crypto and DeFi market. This allows users to make informed investment decisions and stay updated with the latest developments in the industry.

In addition, the portfolio provides customer support to address any queries or concerns that users may have. The support team is committed to assisting users in maximizing their investment returns and providing a seamless user experience.

In conclusion, the DeBank Crypto & DeFi Portfolio 4+ is a powerful investment tool that provides users with a diversified range of investment options in the crypto and DeFi space. With its emphasis on diversification, risk management, regular updates, active portfolio management, and educational resources, this portfolio aims to help users maximize their returns and navigate the ever-changing world of decentralized finance.

Diversification: The Key to Maximizing Returns

When it comes to investing in the DeBank crypto and DeFi portfolio, diversification is the key to maximizing returns. Diversification refers to spreading your investments across different asset classes, sectors, and regions in order to reduce risk.

By diversifying your portfolio, you’re not putting all your eggs in one basket. Instead, you’re spreading your investments across a variety of assets, such as cryptocurrencies, tokens, and DeFi projects. This can help protect your investment from volatility in any one particular asset or sector.

One of the main benefits of diversification is that it can help smooth out returns over time. While some assets may be experiencing a downturn, others may be performing well, balancing out the overall performance of your portfolio. This can help cushion the impact of any potential losses and potentially increase your overall returns.

Another advantage of diversification is that it allows you to take advantage of different investment opportunities. By investing in a variety of assets, you can capitalize on the growth potential of different sectors and regions. For example, while cryptocurrencies may be experiencing a bull market, the DeFi sector may provide opportunities for high yields. By diversifying your investments, you can participate in both trends and maximize your returns.

However, it’s important to note that diversification does not guarantee profits or protect against losses. It’s still possible to experience losses, especially in volatile markets. Therefore, it’s important to carefully evaluate each asset and project before investing and to regularly monitor and rebalance your portfolio based on your investment goals and risk tolerance.

In conclusion, diversification is an essential strategy for maximizing returns in the DeBank crypto and DeFi portfolio. By spreading your investments across a range of assets, you can potentially reduce risk, smooth out returns, and take advantage of different investment opportunities. Remember to conduct thorough research and monitor your portfolio to ensure it aligns with your investment objectives and risk tolerance.

Analyzing Market Trends for Informed Decision Making

When it comes to maximizing returns in your DeBank Crypto & DeFi portfolio, it is important to analyze market trends in order to make informed decisions. By studying and understanding market trends, you can better anticipate the direction in which the market may move, which can help you make more profitable investment choices.

Research and Data Analysis

One of the main ways to analyze market trends is through conducting thorough research and data analysis. This involves studying historical price charts, market indicators, and relevant news and events that may impact the crypto and DeFi markets. By analyzing this data, you can identify patterns and trends that can provide valuable insights into the market’s behavior.

Technical Analysis

Technical analysis is another important tool for analyzing market trends. It involves studying price charts and using various indicators and chart patterns to predict future price movements. This method relies on the belief that historical price data can help predict future price trends. By analyzing factors such as support and resistance levels, moving averages, and volume indicators, you can gain a better understanding of where the market may be headed.

It is important to note that no analysis method can guarantee accurate predictions of market movements. However, by combining different analysis techniques and keeping abreast of the latest market news and information, you can make more informed decisions and increase the chances of maximizing your returns in the DeBank Crypto & DeFi portfolio.

What is the DeBank Crypto & DeFi Portfolio 4+?

The DeBank Crypto & DeFi Portfolio 4+ is a portfolio management tool that helps users maximize returns in the cryptocurrency and decentralized finance (DeFi) space. It offers a range of strategies and features to help users optimize their investments.

How does the DeBank Crypto & DeFi Portfolio 4+ help users maximize returns?

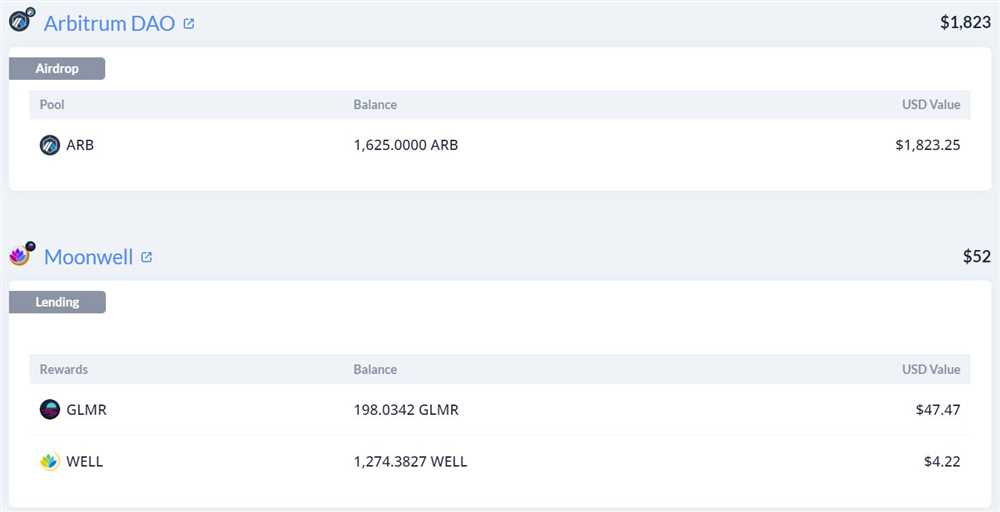

The portfolio management tool provides users with various strategies and tools to optimize their investments. It offers features such as automated portfolio rebalancing, smart contract monitoring, risk analysis, and performance tracking. These features help users make informed decisions and allocate their funds effectively for maximum returns.

What are some of the strategies provided by the DeBank Crypto & DeFi Portfolio 4+?

The DeBank Crypto & DeFi Portfolio 4+ offers a range of strategies to help users maximize returns. These strategies include diversification across different cryptocurrencies and DeFi projects, automated portfolio rebalancing based on user-defined parameters, yield farming, and staking. The tool also provides access to various DeFi protocols and liquidity pools for users to take advantage of different investment opportunities.

How does the automated portfolio rebalancing feature work in the DeBank Crypto & DeFi Portfolio 4+?

The automated portfolio rebalancing feature in the DeBank Crypto & DeFi Portfolio 4+ allows users to set target allocations for their investments. The tool then periodically checks the portfolio’s current allocation and rebalances it to match the user-defined targets. This helps maintain a balanced and diversified portfolio, ensuring that users are taking advantage of different investment opportunities and minimizing risks.

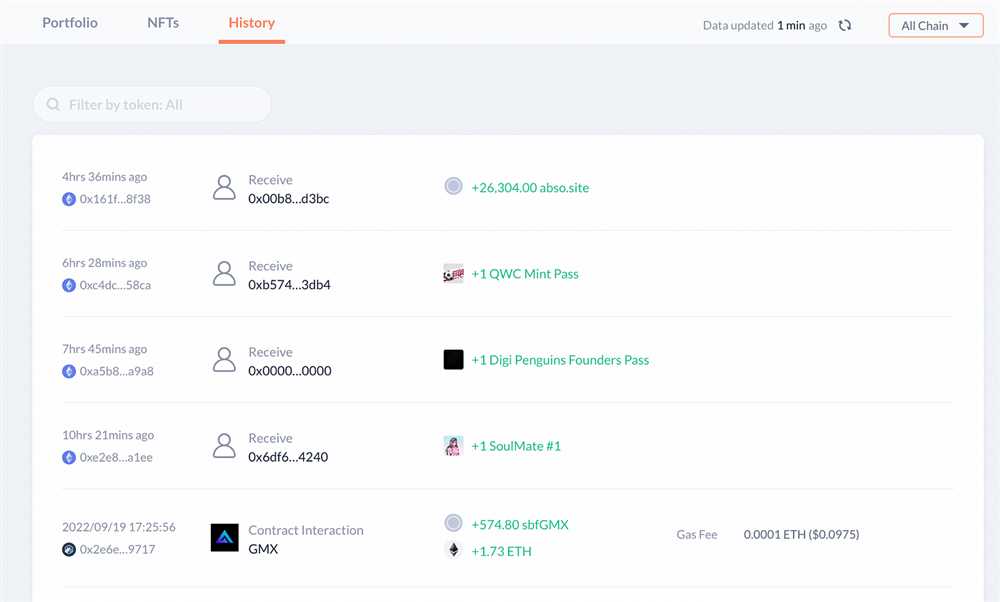

Can users track the performance of their investments in the DeBank Crypto & DeFi Portfolio 4+?

Yes, the DeBank Crypto & DeFi Portfolio 4+ provides users with performance tracking tools. Users can see the overall performance of their investments, gain insights into the returns generated by different strategies, and track their portfolio’s performance over time. This feature helps users assess the effectiveness of their investment decisions and make adjustments accordingly.