Introducing Debank API, the groundbreaking solution that revolutionizes the way you access and analyze banking data. Say goodbye to complex and time-consuming processes, and hello to seamless transparency.

With Debank API, you can effortlessly connect to your bank accounts, credit cards, and financial institutions, allowing you to effortlessly retrieve real-time information about your finances.

Our powerful API gives you access to a vast array of data, including account balances, transaction history, and spending trends. With this valuable information at your fingertips, you’ll gain a complete and accurate understanding of your financial position.

Transparency is the key to making informed financial decisions, and Debank API is here to empower you with the insights you need. Whether you’re a fintech startup, a financial advisor, or an individual looking to take control of your finances, our API is tailored to meet your specific needs.

Don’t settle for guesswork when it comes to your finances. Choose Debank API and take the guesswork out of banking. Experience the future of transparent banking today!

What is Debank API

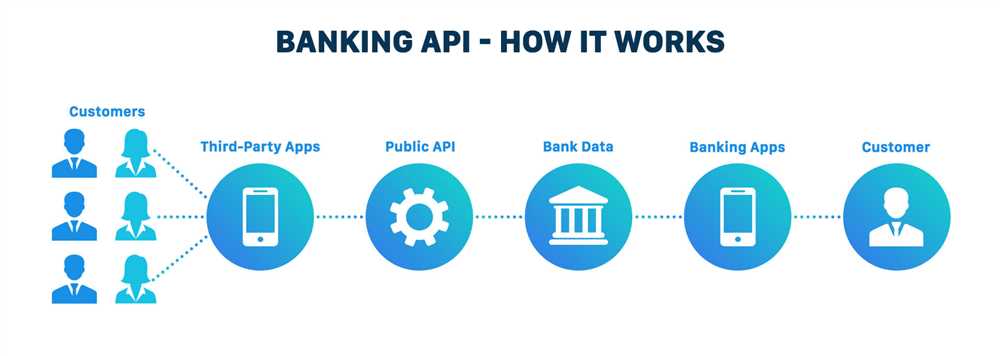

The Debank API is a powerful tool that allows developers to integrate transparent banking services into their applications. With the Debank API, users can access a wide range of financial information, including account balances, transaction history, and spending patterns. This data is collected and aggregated from multiple banks, providing users with a comprehensive overview of their finances in one place.

By leveraging the Debank API, developers can easily build applications that provide users with real-time insights into their financial health. Whether it’s building a budgeting app, a personal finance management tool, or a loan recommendation service, the Debank API makes it possible to create innovative solutions that help users make informed financial decisions.

One of the key features of the Debank API is its emphasis on transparency. Traditional banking systems often lack transparency, making it difficult for users to fully understand their financial situation. The Debank API aims to change that by providing users with clear and concise information about their finances. This includes detailed transaction descriptions, categorization of expenses, and visualizations of spending trends.

The Debank API also makes it easy for developers to add additional features and functionality to their applications. Whether it’s generating personalized financial reports, building predictive models, or creating custom financial goals, the Debank API provides a flexible platform for developers to build upon.

In summary, the Debank API is a powerful tool that enables developers to integrate transparent banking services into their applications. By providing users with access to comprehensive financial information in a user-friendly and transparent manner, the Debank API empowers users to take control of their financial health and make informed decisions.

Benefits

Debank API provides various benefits to enhance transparency in banking:

| Benefits | Description |

|---|---|

| Real-time Data | Access real-time data on financial transactions, balances, and account details. Stay updated with the latest information to make informed decisions. |

| Improved Security | Debank API ensures secure access to banking information through encrypted communication and authentication protocols. Protect your sensitive data from unauthorized access. |

| Streamlined Processes | Automate banking processes by integrating Debank API into your existing systems. Reduce manual effort and errors associated with manual data entry. |

| Customizable Solutions | Debank API offers customizable solutions to meet your specific requirements. Tailor the integration to fit your organization’s unique needs and workflows. |

| Enhanced Customer Experience | Provide a seamless banking experience to your customers by offering real-time access to their accounts and transactions. Increase customer satisfaction and loyalty. |

| Compliance and Reporting | Ensure compliance with regulatory and reporting requirements. Debank API simplifies data retrieval and reporting processes, saving you time and effort. |

Experience the benefits of improved transparency in banking with Debank API. Stay ahead of the competition and offer your customers a secure and efficient banking experience.

Improved Transparency in Banking

Transparency is a crucial aspect of the banking industry as it builds trust between customers and banks. With the Debank API, banks can ensure improved transparency in their operations, benefitting both customers and the overall financial ecosystem.

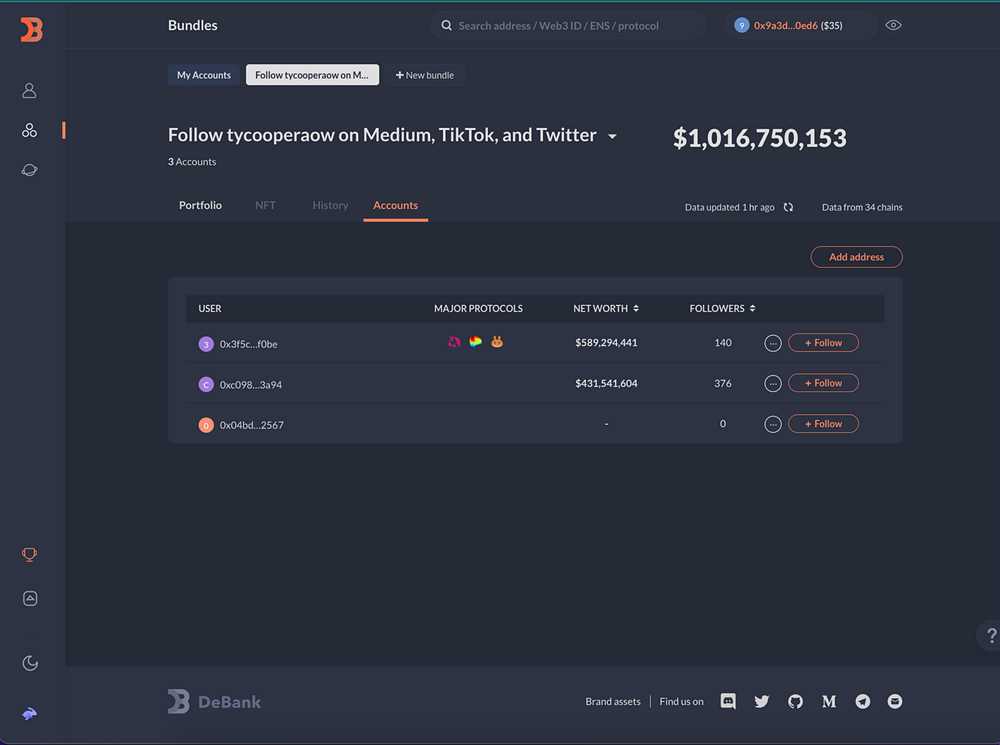

Increased Access to Information

By leveraging the power of the Debank API, banks can provide their customers with real-time access to their financial data. Customers can easily retrieve information about their account balances, transaction history, and other relevant details. This level of transparency empowers customers to make informed financial decisions and keep track of their finances effectively.

Enhanced Risk Management

The Debank API facilitates efficient risk management practices in the banking sector. Banks can access accurate and up-to-date data on customer transactions, allowing them to identify potential risks promptly. With this information, banks can enhance their fraud detection systems and implement more effective measures to protect customer accounts from unauthorized activities. This contributes to a safer and more secure banking environment for everyone involved.

| Benefits of Improved Transparency in Banking: |

|---|

| 1. Empowers Customers: By providing access to real-time financial data, customers can make informed decisions and take control of their finances. |

| 2. Builds Trust: Improved transparency fosters trust between customers and banks, leading to more fruitful and long-lasting relationships. |

| 3. Risk Mitigation: With enhanced risk management practices, banks can identify potential risks and take preventive measures promptly. |

| 4. Competitive Advantage: Banks that prioritize transparency gain a competitive edge by demonstrating their commitment to customer satisfaction and security. |

In summary, the Debank API plays a vital role in improving transparency in banking. By providing customers with real-time access to their financial information and facilitating efficient risk management, it contributes to a more secure and trustworthy banking environment. The benefits of improved transparency extend to both customers and banks, fostering stronger relationships and promoting financial well-being.

What is Debank API?

Debank API is a service that provides access to a wide range of banking data and allows developers to integrate this data into their own applications.

How can Debank API improve transparency in banking?

Debank API improves transparency in banking by providing access to real-time data on financial transactions, account balances, and other relevant information. This allows consumers to have a clearer understanding of their financial situation and make more informed decisions.