With the rise in popularity and adoption of cryptocurrencies, including Bitcoin and Ethereum, many individuals are exploring the world of crypto trading. As this market continues to expand, so does the need for regulations and compliance measures. One such measure is the Know Your Customer (KYC) process, which plays a crucial role in the crypto cash out process.

KYC refers to the steps and procedures used by financial institutions and other businesses to verify the identity of their customers. When it comes to cryptocurrencies, KYC ensures that individuals are not using digital assets for illicit activities, such as money laundering or terrorist financing. It also helps protect users by preventing unauthorized access to their accounts and ensures compliance with anti-money laundering (AML) laws and regulations.

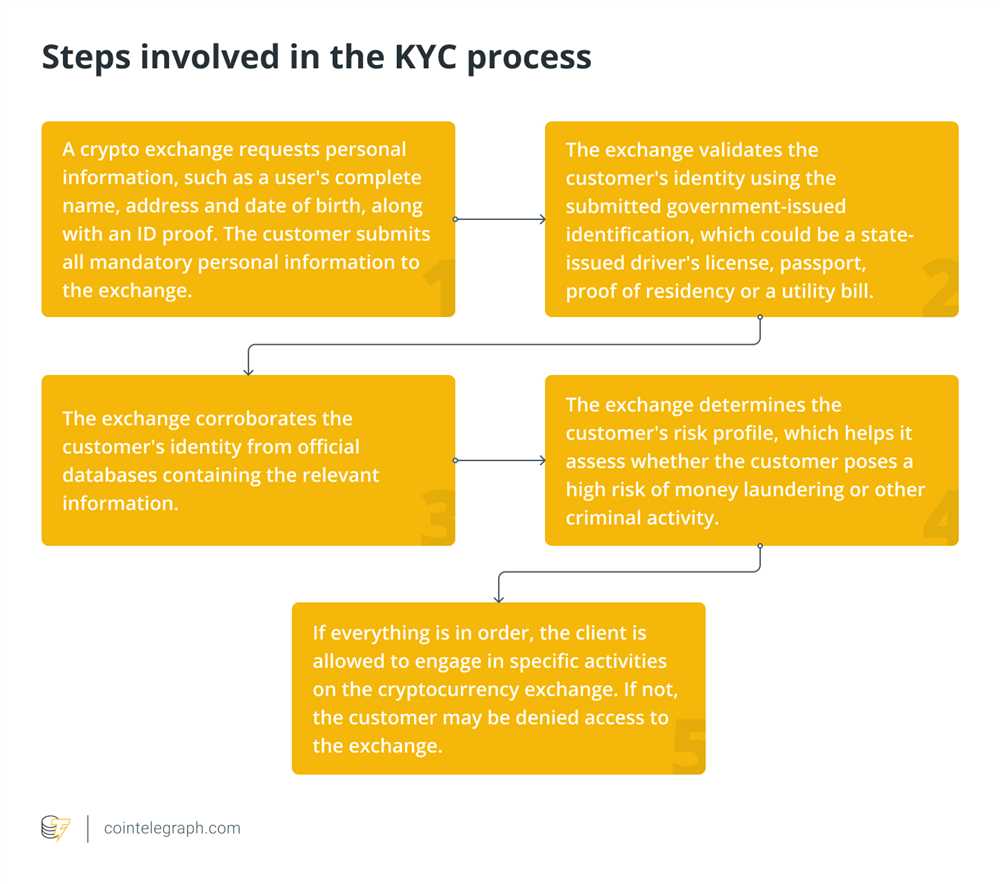

When cashing out crypto assets, individuals are often required to provide personal information and documentation to verify their identity. This can include a government-issued ID, proof of address, and sometimes even a selfie or video verification. KYC procedures vary from one platform or exchange to another, but the ultimate goal remains the same – to establish the true identity of the user.

While some individuals might find KYC procedures tedious or intrusive, it is important to recognize their significance. By implementing KYC measures, crypto platforms and exchanges can create a safer and more transparent environment for users. It also helps build trust and credibility within the industry, making cryptocurrencies a more reliable and legitimate alternative for traditional finance.

The Importance of KYC in Cryptocurrency Cash Out

In the world of cryptocurrency, cashing out your assets can be an exciting yet challenging process. One important aspect that cannot be ignored when cashing out is KYC, or Know Your Customer.

KYC refers to the verification process that all legitimate cryptocurrency exchanges and platforms require their users to complete. It involves providing personal identification information, such as ID cards, passports, and proof of address, to prove your identity.

The importance of KYC in cryptocurrency cash out cannot be overstated. It serves as a crucial measure to prevent fraud, money laundering, and illicit activities. By verifying the identity of individuals, it helps establish a level of trust and security in the system.

Additionally, KYC also plays a significant role in complying with regulations and laws governing cryptocurrencies. Many jurisdictions require businesses dealing with cryptocurrency to adhere to strict anti-money laundering (AML) and counter-terrorism financing (CTF) measures. Failure to comply with these regulations can result in severe penalties or even the closure of the business.

Moreover, KYC is essential for the overall reputation and credibility of the cryptocurrency industry. It helps weed out bad actors and promotes a safer and more transparent ecosystem. This, in turn, attracts more individuals and institutional investors to participate in cryptocurrency trading.

While some individuals may view KYC as a cumbersome and time-consuming process, it is a necessary step to ensure the integrity and legitimacy of cryptocurrency cash outs. By complying with KYC requirements, individuals can enjoy the benefits of a secure and regulated environment.

In conclusion, KYC plays a crucial role in the cryptocurrency cash out process. It contributes to the prevention of fraud, money laundering, and illegal activities. It also helps businesses comply with regulations and enhances the industry’s reputation. So, next time you cash out your cryptocurrency, remember the importance of KYC.

Enhancing Security and Compliance

When it comes to cashing out cryptocurrency, security and compliance are of utmost importance. KYC (Know Your Customer) measures play a critical role in ensuring that the cash out process is secure and compliant with regulations.

By implementing KYC procedures, crypto exchanges can verify the identity of their users and ensure that they are not involved in any illicit activities, such as money laundering or terrorism financing. This helps in maintaining the integrity of the financial system and prevents the misuse of cryptocurrencies for illegal purposes.

KYC also helps exchanges to build trust with their users. By conducting thorough due diligence and identity verification checks, exchanges can demonstrate their commitment to security and compliance. This, in turn, gives users confidence in the platform and encourages them to fully participate in the cash out process.

Furthermore, KYC procedures help exchanges to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. By collecting and verifying user information, exchanges can monitor for suspicious activities and report them to the respective authorities. This contributes to the overall efforts in combating financial crimes associated with cryptocurrencies.

In addition to enhancing security and compliance, KYC measures also protect exchanges from potential legal issues. By ensuring that they have proper documentation and verification processes in place, exchanges can shield themselves from legal and regulatory repercussions.

In conclusion, implementing KYC measures in the cash out process of cryptocurrencies is crucial for enhancing security and compliance. It not only helps in preventing illicit activities but also builds trust with users and protects exchanges from legal issues. As the crypto industry continues to evolve, KYC will remain an essential component in ensuring the integrity and stability of the cryptocurrency ecosystem.

Reducing Money Laundering Risks

Money laundering poses a significant risk in the cryptocurrency industry, as it provides an avenue for individuals to hide and transfer illicitly obtained funds. To combat this threat, KYC (Know Your Customer) procedures are implemented by crypto cash out service providers.

KYC requires individuals to provide identification documents, such as passports or driver’s licenses, to verify their identity. This information is then cross-checked against various databases to ensure the person is not associated with any criminal activity or sanctions-related offenses. By implementing robust KYC procedures, crypto cash out service providers can significantly reduce the risks of money laundering in the industry.

The Importance of KYC in Money Laundering Prevention

KYC plays a crucial role in preventing money laundering in the cryptocurrency industry. Without proper identification and verification, it becomes easy for criminals to exploit the decentralized nature of cryptocurrencies and move funds across borders without leaving a trace.

By implementing KYC procedures, crypto cash out service providers establish a layer of transparency and accountability. This ensures that individuals using their platforms are legitimate, and any suspicious activities can be flagged and reported to the relevant authorities.

The Role of Technology in KYC

Technology plays a crucial role in enhancing the effectiveness of KYC procedures. Automated software and AI algorithms can be used to verify identification documents, perform risk assessments, and detect patterns of suspicious transactions. These technological advancements not only streamline the KYC process but also improve the accuracy and efficiency of identifying potential money laundering risks.

| Benefits of KYC in Money Laundering Prevention: |

|---|

| 1. Increased transparency and accountability |

| 2. Enhanced detection and reporting of suspicious activities |

| 3. Deterrence for criminals considering money laundering in cryptocurrencies |

| 4. Compliance with regulatory requirements |

Overall, KYC procedures play a vital role in reducing money laundering risks in the crypto cash out process. By implementing strict identification and verification measures, service providers can ensure the integrity of their platforms and contribute to a safer cryptocurrency industry.

What is KYC and why is it important in the crypto cash out process?

KYC stands for Know Your Customer and it is an important process in the crypto cash out process because it helps to prevent fraud, money laundering, and other illegal activities. It requires individuals to provide personal information and documentation to verify their identity.

What information is typically required for KYC in the crypto cash out process?

The information typically required for KYC in the crypto cash out process includes personal details such as full name, date of birth, address, and identification documents such as passport or driver’s license. Some platforms may also require additional information or documents depending on their specific requirements.

How long does the KYC process usually take?

The length of the KYC process can vary depending on the platform and the individual’s responsiveness in providing the required information. In general, the process can take anywhere from a few minutes to a few days. Some platforms may require manual review of the submitted documents, which can take longer.

Can I cash out my crypto without going through the KYC process?

It depends on the platform you are using. Some platforms strictly require KYC verification for cashing out crypto, while others may offer certain limits or options for cashing out without KYC. However, it is important to note that most reputable platforms prioritize user security and compliance with regulatory requirements, which often include KYC procedures.

What are the potential risks of not completing the KYC process?

Not completing the KYC process can result in limitations on your account, such as restricted cash out options or reduced transaction limits. Additionally, failing to comply with KYC requirements may result in suspension or closure of your account if the platform detects any suspicious activity or potential violation of regulations.