Discover the cutting-edge innovations that are revolutionizing London’s financial industry. From blockchain technology to artificial intelligence, financial institutions in the heart of the city are embracing digital transformation to stay ahead in today’s fast-paced digital world.

Stay competitive and ensure the success of your business by leveraging the latest technological advancements. Take a deep dive into the digital strategies and solutions that London’s financial institutions are implementing to streamline operations, enhance customer experience, and drive growth.

Uncover the benefits of digital transformation and gain valuable insights from industry leaders. Learn how London’s financial institutions are leveraging data analytics to make informed decisions, implementing mobile banking solutions to offer convenient services, and utilizing robo-advisors to enhance investment strategies.

Join the revolution and embrace digital transformation to position your business at the forefront of innovation. Explore the vast opportunities that London’s financial sector has to offer with its forward-thinking approach to technology.

London’s Financial Institutions and Digital Transformation

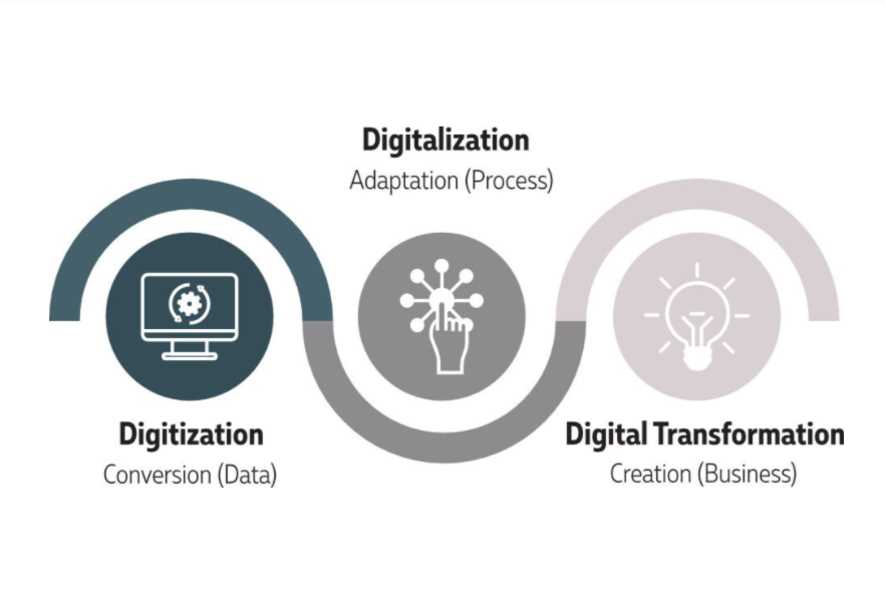

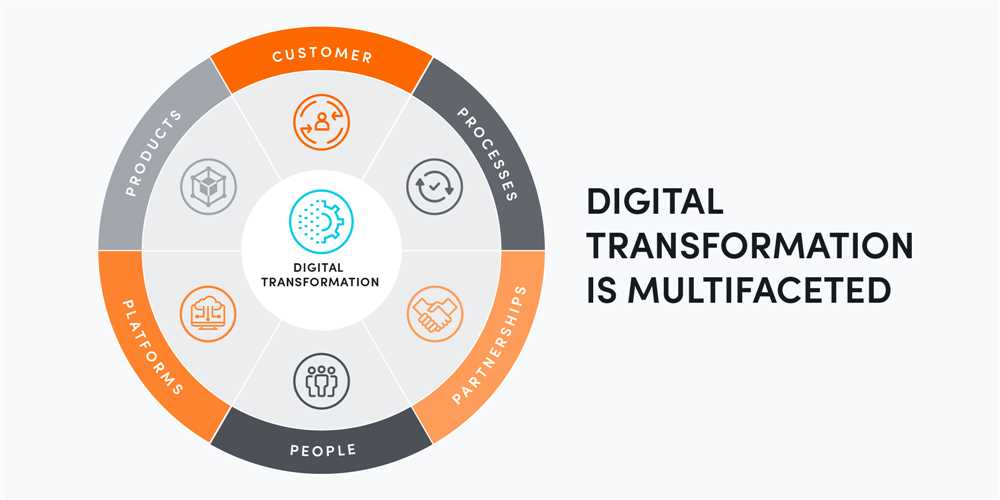

In today’s rapidly evolving technological landscape, digital transformation has become a critical strategy for London’s financial institutions. With the rise of fintech startups and increased demand for seamless digital experiences, traditional financial institutions are facing the need to adapt and innovate to stay competitive.

One of the key drivers behind London’s financial institutions embracing digital transformation is the changing expectations of customers. In an era where convenience and speed are paramount, customers expect their financial services to be available anytime, anywhere, and on any device. By embracing digital technology, London’s financial institutions can meet these expectations and provide a more personalized and convenient customer experience.

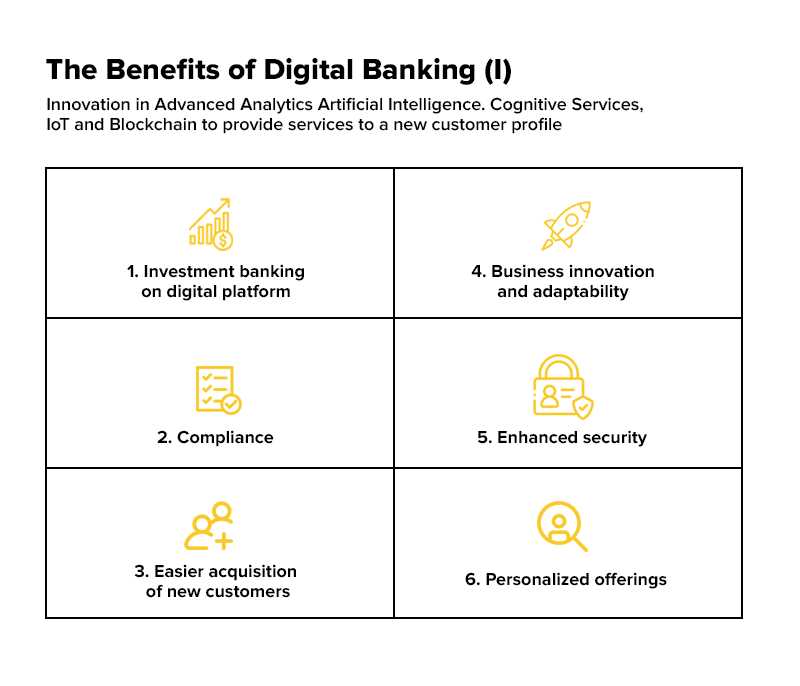

Benefits of Digital Transformation

By embracing digital technologies, London’s financial institutions can gain several benefits. One of the most significant benefits is the ability to streamline processes and increase operational efficiency. Automation of manual processes can reduce the risk of errors and improve the speed of transactions, resulting in cost savings and improved productivity.

Digital transformation also allows financial institutions to leverage data analytics to gain valuable insights into customer behavior and preferences. By analyzing large volumes of data, institutions can better understand their customers and tailor their services to meet their needs. This not only enhances the customer experience but also enables institutions to develop targeted marketing strategies that can drive business growth.

Challenges and Considerations

While the benefits of digital transformation are clear, financial institutions in London also face several challenges and considerations. One of the main challenges is ensuring the security and privacy of customer data. As financial institutions become more digitally connected, they must implement robust cybersecurity measures to protect sensitive information.

Another consideration is the need for effective change management. Digital transformation often involves significant changes to processes, systems, and workflows. To successfully implement these changes, financial institutions must have a robust change management strategy in place, including employee training and communication.

In conclusion, London’s financial institutions are embracing digital transformation to better meet the changing needs and expectations of customers. By leveraging digital technologies, they can streamline operations, enhance the customer experience, and gain a competitive edge in the constantly evolving financial landscape.

The State of Digitalization in London

London’s status as a global financial center has accelerated the adoption of digital technologies within its financial institutions. The city’s thriving fintech ecosystem and regulatory framework have fostered an environment that encourages innovation and digital transformation.

With the rise of digitalization, London’s financial institutions have embraced various technologies to optimize their operations and deliver enhanced services to their customers. One of the key areas of digital transformation in London is the adoption of cloud computing. Financial institutions are increasingly migrating their infrastructure and data to the cloud, enabling them to scale their operations, improve security, and provide more personalized experiences to their customers.

Another area of digitalization in London’s financial sector is the use of artificial intelligence (AI) and machine learning. These technologies are being leveraged to automate processes, reduce costs, and enhance decision-making capabilities. For example, AI-powered chatbots are being deployed to provide customer support and streamline customer interactions.

Furthermore, London is witnessing an increased focus on cybersecurity as financial institutions recognize the importance of protecting customer data and mitigating cyber threats. The city is home to various cybersecurity startups and research centers, which are working collaboratively with financial institutions to develop innovative solutions and enhance the resilience of London’s financial sector.

Additionally, London’s financial institutions are investing in digital payment systems and mobile banking services to meet the changing needs and preferences of their customers. Mobile apps and digital wallets are becoming increasingly popular, allowing customers to make payments, manage their accounts, and access financial services on the go.

In conclusion, the state of digitalization in London’s financial institutions is thriving. The city’s financial sector continues to embrace digital technologies to drive operational efficiency, improve customer experiences, and stay competitive in the global financial landscape.

Benefits and Challenges of Digital Transformation

Digital transformation brings numerous benefits to both businesses and consumers in the financial industry in London. Here are some of the major advantages:

Increased Efficiency and Productivity

By embracing digital technologies, financial institutions in London can automate repetitive tasks, streamline processes, and eliminate paper-based transactions. This results in increased efficiency and productivity as employees can focus on more value-added tasks.

Enhanced Customer Experience

Digital transformation allows financial institutions to offer personalized services and tailored experiences to their customers. With the help of advanced analytics and data-driven insights, institutions can understand their customers better and provide them with relevant products and services, leading to higher customer satisfaction.

However, digital transformation also comes with various challenges that financial institutions need to overcome:

Security and Data Privacy

The digital world brings new cybersecurity risks, such as data breaches and identity theft. Financial institutions need to invest in robust cybersecurity measures and ensure the privacy of customer data to protect against potential security threats.

Legacy Systems Integration

Integrating new digital technologies with existing legacy systems can be complex and challenging. Financial institutions often need to update their infrastructure and ensure compatibility between old and new systems, which requires careful planning and execution.

In conclusion, while there are numerous benefits to be gained from digital transformation in the financial industry, it is important for institutions to address the associated challenges and invest in the necessary resources and expertise to ensure a successful transition.

What is “How London’s Financial Institutions are Embracing Digital Transformation” about?

“How London’s Financial Institutions are Embracing Digital Transformation” is a book that explores the ways in which financial institutions in London are adapting and integrating digital technologies into their operations and services.

Who is the target audience for “How London’s Financial Institutions are Embracing Digital Transformation”?

The target audience for this book is professionals in the finance industry, including executives, researchers, and technology experts, who are interested in understanding how London’s financial institutions are embracing digital transformation.

What are some key insights provided in “How London’s Financial Institutions are Embracing Digital Transformation”?

This book provides key insights into the various digital transformation strategies and initiatives undertaken by financial institutions in London. It covers topics such as the adoption of cloud computing, artificial intelligence, blockchain, and data analytics in the finance industry. It also explores the challenges and opportunities associated with digital transformation and offers case studies of successful implementations.